If you have a company car, then the chances are you will have to pay company car tax. It’s just one of those things.

Company Car Tax Guide

If you have a company car, then the chances are you will have to pay company car tax. It’s just one of those things.

How does company car tax work? In this article, we look at everything you need to know about company car tax; from how it’s calculated to its exemptions, and company car tax for vans.

Do I have to pay company car tax?

Firstly, let’s look at whether you even have to pay company car tax.

If you use your company car privately, then you do have to pay company car tax. This includes journeys to and from work. So, if you use your car for commuting and for the weekly shop, then you will have to pay company car tax.

You do not have to pay company car tax if;

- You do not use your company car privately

- This usually means you keeping the vehicle on business premises overnight and at weekends and use it strictly for business – for example, transporting clients.

- It is a ‘pool’ car

- This means that other employees use the vehicle for business purposes – for example, going to training away days.

- Again, the car is usually kept on business premises overnight and at weekends.

- If the car is adapted for mobility reasons

You are also exempt from company car tax if;

- You are a Partner of a Partnership

- You are a Member of a Limited Liability Partnership (LLP)

- You own your own business (are a sole trader)

How to calculate company car tax

We’ve established who has to pay company car tax, so how is it calculated?

Company car tax is calculated depending on three things;

- The P11d Value of your car

- The amount of CO2 the car emits

- Your personal tax bracket (20 or 40%)

You can calculate how much you will have to pay as follows;

- Take your vehicle’s P11d value

- Multiply this by your BIK rate

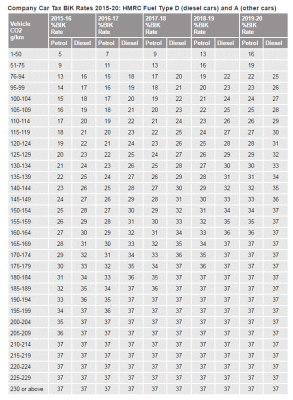

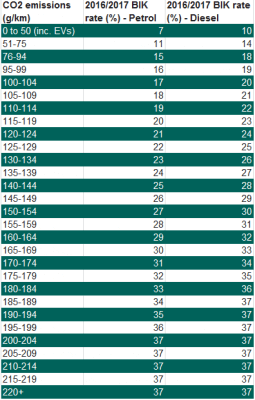

- The BIK rate is based on the CO2 emissions and the fuel type – you can find out your BIK rate via the table below (the BIK rates in the table below are valid until April 2017, but we go into more detail about that in a minute)

- Multiply that by your income tax rate

And that will equal how much you have to pay per year in company car tax.

Alternatively, you can use an online company car tax calculator or contact a knowledgeable vehicle broker who will be happy to do the maths for you or ask your Accountant.

Company car tax changes 2017

The table above, as already mentioned, is only valid until April 2017. That is because, as of April 2017, there will be changes to company car tax.

When the current company car tax bandings were introduced, there weren’t as many low emission cars on the roads as there are today. This is great news for the environment, but it now means that the BIK rates are unfairly distributed.

However, they have now updated the BIK rates so that they are considerably more equal. Fifteen more bands have been introduced, and eleven of those are for the cars that are on the lower end of the scale. As you can see below, the BIK bands are more evenly distributed.

Company car tax for vans

In this article, we’ve spoken a lot about cars, and not at all about vans. Vans are taxed differently to how company cars are taxed, which is why we’ve separated them.

The main difference is that a car is taxed via a sliding BIK rate. A van, however, has a fixed BIK rate that can be reduced by a number of things.

How to calculate company car tax for vans

The rules for paying company car tax on a van are pretty similar in terms of private use. However, it is slightly more flexible. According to the HMRC, a private journey in a van is a trip;

- That is made as part of work (travelling to and from appointments etc)

- To a temporary workplace

You can also use your car for ‘insignificant’ private journeys without having to pay company car tax. This could include grabbing a coffee or stopping to pick up a newspaper on the way to work, for example.

You also do not have to pay company car tax if your van is a ‘pool’ van. That is, a van that is;

- Available for use and is used by more than 1 employee

- Available to each employee

- Isn’t normally kept at, or near, employees’ homes

- Only used for business journeys

Now we’ve established that, how do you calculate it?

If you are using your van for private journeys, then you have to pay £3,150 as standard. So, if you are on the 20% personal tax rate, then you will be paying £630 a year or £52.50 a month.

And that’s essentially how you calculate company car tax for a van. As there is no sliding BIK rate for vans, the changes to company car tax do not affect vans, and they will continue to be taxed in the same way.

Hopefully this has given you an idea of how company car tax works for cars and vans. Remember that the new changes will come into effect in April of this year (2017).

However, if you get a company car before April 2017, then you will not be effected by the changes. If you are in doubt about anything regarding company car tax, we recommend speaking to a knowledgeable broker who will be happy to help you.

Debbie Kirkley is joint-company Director of OSV, UK independent vehicle supply professionals.

Thanks for signing up to Minutehack alerts.

Brilliant editorials heading your way soon.

Okay, Thanks!