Laybuy: The Answer To Retail's Credit Conundrum?

The family-owned start-up could become one of New Zealand's biggest business exports.

Gary Rohloff, co-founder & MD of buy now, pay later business Laybuy [pictured right with his son and co-founder Alex], tells Minutehack how its model beats the competition by providing a win-win for retailers and consumers, without lumping financial pressure on either group.

What’s the business in a nutshell?

Laybuy is New Zealand’s largest buy now, pay later service. Built by retailers, for retailers, our payment platform integrates seamlessly in-store and online, which allows shoppers to receive their purchase immediately and spread the payment over six weeks.

It’s free for consumers to sign up and is totally interest free. Laybuy pays merchants up front and absorbs all the financial risk.

Despite only launching in May 2017, almost 10% of New Zealand’s voting population has already signed up to our platform to pay by Laybuy both online and in-store. We’re also lucky enough to have forged partnerships with over 4,000 online and physical stores across New Zealand and Australia.

Following our success in the Southern Hemisphere, we will officially be launching very soon with a major UK retailer.

Why did you start it?

The initial idea for Laybuy was born in the early 2000s when I was running a company called EziBuy (Australasia’s largest catalogue business). At the time we were looking for a way to improve our average order value as we noticed that whatever we tried to do, our customers’ discretionary income was finite and we couldn’t increase our basket size.

Our board, however, wasn’t overly keen on the risk profile associated with buy now, pay later and we also weren’t able to perform a digital credit check the way we can today. This made the economics hard to justify.

Wind the clock forward to 2016, and, having observed the likes of Klarna and Affirm, as well as witnessing what was happening in the Australian retail market, I decided to leave the corporate world after thirty-five years and start the business alongside my wife and our two sons.

How did the business develop?

Scaling in New Zealand was reasonably straightforward for us; it’s a bit of a village with a population of only 4.7 million people. Then came scaling in Australia; a market that is also relatively familiar with buy now, pay later.

Expanding to the UK however has been a brave new world. Much of our focus has been educating on the buy now, pay later success we’re experiencing in Australasia and the opportunity for merchants to gain incremental sales, increase their basket size and have access to new customers.

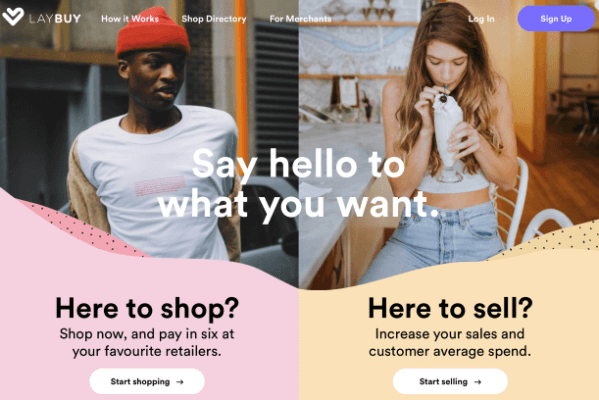

The Laybuy website homepage

Tell us about the market conditions

Since arriving in the UK in August last year, the reception to our product has been in line with our expectations. Laybuy is new to the market here, so there’s been a real need to raise awareness of our product and its benefits – both to the consumer and the retailer.

In our experience, consumers love the ability to split their purchases over six weekly payments. It’s manageable and it’s been consistent with how people manage their discretionary income not only in the UK, but also in Australasia.

The number one priority when we engineered our payment model and as we continue to develop it, was and remains ensuring that it is as transparent, as seamless and as clear for the consumer as humanly possible.

What’s been the biggest challenge?

When we first launched in New Zealand, our initial plan was to have signed 200 retailers by June 2019. In fact, we achieved this within the first three months, which blew our forecasts out the window.

This meant that we had to return to the drawing board in terms of our funding lines. We had to do this, not from an operational growth perspective, but rather to support our debtor ledger that had far surpassed our original expectations.

Overcoming this challenge was particularly difficult because we were creating a business model that was previously unseen in New Zealand.

Banks really struggled with the fact that we were offering unsecured consumer credit and just couldn’t get their heads around our exponential growth rate, the notion of what our debtor ledger actually was and the pace the entire ledger turned over; it was all very new.

Securing the kind of funding we needed to be comfortable with our growth trajectory took about seven months. And, like a lot of other small fast-growing companies, we had no choice but to offer up more personal assets to secure it. Once we made that commitment, the banks were willing to get on board.

What has been your biggest mistake?

What’s my biggest mistake? Thankfully no one thing really stands out, but there are of course things I could have done differently.

Looking back, I think I should probably have tried to be more understanding of the pressures and stresses experienced by both my family and those around me.

Once I’m in the zone I’m perhaps not as measured as I should be. That’s not the best way to be in business generally, but especially not in a small family business like ours. This is something I’m trying really hard to actively change.

Believe it or not, coping with fast growth is a challenge

What major bumps in the road have you had and how did you overcome them?

Looking back now, it was certainly more of a positive than a negative. Although at the time, coping with the pace of growth we experienced in the early days was still an issue that we still had to overcome.

Making sure we met the liquidity requirements to cope with that growth was therefore constantly front of mind.

Yet, in many respects, it was a quality problem to have - we just grew so fast that we were running out of runway! For any fast-paced business, the ability to access capital when you don’t have a longstanding track record is a perennial issue.

The capital markets (debt and equity) all want to see your 18 to 24-month trading history and we were simply unable to provide that given we will only turn two years old in May this year.

What sets your business apart from the rest?

Our merchants actually get direct access to the owners. This makes us nimble, which is only reinforced by the fact that no other provider has the cutting-edge technology that we have today and in our development pipeline.

When we were scoping out the design for our product, our strategic goal was to create a global solution from day one. We wanted the ability to effectively turn on the functionality as and when it was needed, rather than have to scramble to integrate it at a later date.

Our developers worked hard as group to ensure Laybuy offered a currency agnostic solution that gives our merchants a huge pool of potential new global customers.

My 20 years working in finance taught me just how critical it was that our credit checks were not only independent, but also borderless. This is what set us apart from the beginning and continues to do so today.

How did you attract and retain good people?

We’ve always had the luxury as a family run business of being able to handpick every single person we employ. More or less everyone who’s come to us has done so with a real passion for wanting to get involved in something special.

Despite only being almost two years old, we’ve retained these people because they share our vision of creating a ubiquitous global brand. I’m excited and humbled that so many people have wanted to be a part of that.

What’s your best advice to others?

You have to believe 100% in what you’re doing and think through your strategy carefully. If you’ve done your homework and you have the confidence in your product, you need to be prepared to back it all the way. When there’s no safety net, you make it work, you adapt, and you never give up.

Thanks for signing up to Minutehack alerts.

Brilliant editorials heading your way soon.

Okay, Thanks!