Two and a half years after co-founding his digital marketing business, Impression, Aaron Dicks has learned a lot. But it's not the sort of stuff you often get taught at business school.

Lessons I’ve Learned In Business That Couldn’t Be Taught

Two and a half years after co-founding his digital marketing business, Impression, Aaron Dicks has learned a lot. But it's not the sort of stuff you often get taught at business school.

I set up my first start-up when I was 22 years old. A graduate with a business degree from a redbrick university, I thought I knew all the tricks that would be needed to build a successful, sustainable company.

Sitting here two-and-a-half years later as the co-founder of a digital marketing agency turning over half a million pounds a year, I realise I’ve had to learn some hard lessons along the way. Lessons that no amount of education, training or advice from my peers could truly prepare me for.

I can only speak for myself but I suspect I’m not alone, so if I can help someone out there just about to take the thrilling, terrifying plunge into entrepreneurship by sharing my mistakes with them, then more the better.

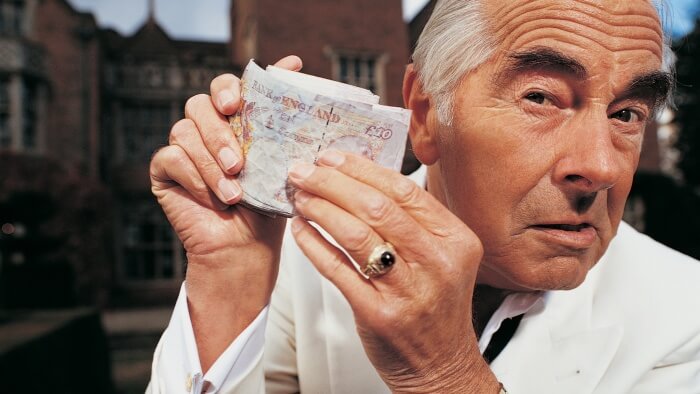

The king is dead; long live cash

Managing cash flow sounds anything but groundbreaking, but it’s first here for a reason.

‘Classical’ business education teaches us how to do five-year plans, growth projections and forecasting - all the obvious things you need to stay profitable and solvent. Yet poorly managed cash-flow is still the second biggest cause of business failure among the nine out of 10 start-ups which don’t make it.

Too many businesses are afraid to ask for the cash they’re owed from their clients, despite late payments holding back their own growth.

After a few failed attempts myself, I read up online and realised that we could limit the risk by automating our cash flow through cloud accounting software, which I actually wrote about here.

I hadn’t realised how easy these payment programs can make business admin, but there’s a wealth of information available online from the suppliers of these software packages which helped us solve our own real-world accounting problems.

Now we know exactly when our money’s coming in and going out every month, without fail. It all happens automatically in the background as we focus on running our business, with alerts notifying us of what we need to do and when. Fewer late payments mean more money in the bank for our own investment, and that’s what’s enabled us to grow rapidly utilising only our profits.

Good ones to consider are Xero, Kashflow and Clearbooks. Even ancient Sage released a cloud solution in the form of SageOne. All allow businesses to avoid high accountancy fees, delegate access to remote accountants when needed and process payroll online, automate recurring invoices, take card payments from invoices and import bank feeds.

Make it easy for the right people to find you

More than anything else, I never thought recruitment would be as difficult as it has been. I thought that getting to the stage where we needed a team in the first place would be the hardest part, however the skills gaps and geographical challenges were two issues I didn’t anticipate.

Never mind the army of recruiters willing to show you dozens of graduates at a moment’s notice for a ‘reasonable’ fee, I was more interested in finding the right people to work for us for whom work is about more than just money.

The trickiest thing was attracting them to us in the first place and to Nottingham, competing on a national level against London and the other regional powerhouses. That was made more difficult by the fact that many technical degrees teaching coding and web development turned out to rarely give the real-world experience that we need.

Traditional business education taught me all about employee behaviour and the importance of building a strong culture like Starbucks, Amazon and the like, but transferring that knowledge into a creative start-up isn’t straight forward.

My solution has been one part perseverance, one part luck and one part ‘suck it and see’. I began by striking up relationships with the people running local business development schemes (in our case, Nottingham’s Creative Quarter proved invaluable - other cities have similar initiatives in place). They promoted our vacancies to the right people in the early days.

After that I just made sure we found out where the right people we wanted skills-wise were, both online and in the real world, then did what we could to show off our company’s personality to them to encourage unsolicited job applications. So far it’s worked out but I’m sure it’ll be an ongoing challenge.

Winning work is easier than being profitable

Two years ago I was sure that our biggest challenge would be winning work, however thanks to the team we’ve built this hasn’t been the case.

In the early days we invested a lot of time and resource into trying to win work and then retain it, without giving much consideration to what any of it would cost us. We were really happy to be working with great local and national companies - sometimes at a cost to ourselves.

Understanding that there’s an opportunity cost to every decision has been a lesson learned the hard way. It’s something every entrepreneur should consider when considering new clients, staff or premises.

To counter this now, I regularly ask myself: ‘Are we doing the right type of work with the right team in place for the right type of clients, or are we taking on work just because it’s there?’. Doing this has helped me be firm enough and use value-based pricing without over-servicing just because we want the work.

Sustainable growth is everything

This is the culmination of all the other lessons I’ve learned. Getting growth and keeping it sustainable leads to everything else; implementing the right systems, getting the right team in place and working out which profitable work you can deliver. More often than not, that work is the stuff you’re most proud of afterwards, anyway.

From watching other startups falter, I’ve realised some people don’t want sustainable growth when they’re faced with it for fear of losing control. I’ve felt this fear, and you never let go of anything completely because it’s on your head if it all goes wrong. But ultimately you can either trust people, delegate and empower them to carry on what you’ve started, or you stagnate.

The trickiest part for every entrepreneur is: ‘at what point do you let go? The answer’s probably different for every person, but for me it was a case of working out the risks involved and what each one was worth in terms of slowing down the growth of the company versus delegating effectively and letting the growth continue.

Surprisingly, time management was the first step to helping me do this - the better I’ve got at it, the easier delegation has been. I couldn’t have done it without the right team on board though - staff who are fully aware of our growth plan and are ready to carry them forwards and smash it.

Thanks for signing up to Minutehack alerts.

Brilliant editorials heading your way soon.

Okay, Thanks!