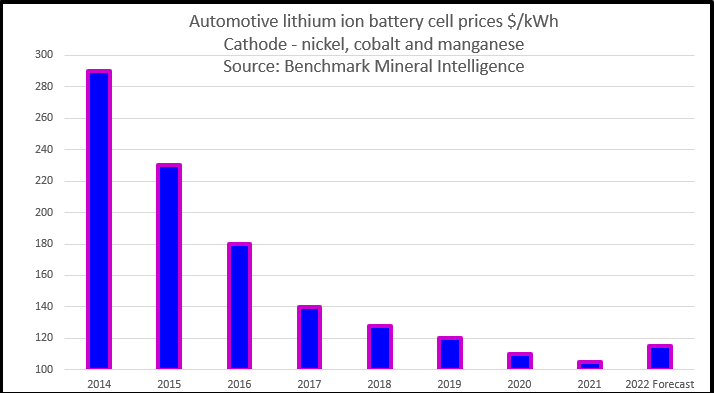

Explainer: The Cost Of Nickel And Cobalt Used In Electric Vehicle Batteries

Prices are rising to recent highs, here's why.

Rising sales of electric vehicles (EVs) and a scramble along the supply chain to secure materials have propelled prices of battery ingredients nickel, cobalt and lithium to multi-year highs.

"Raw material prices and availability are starting to have an impact on prices of battery cells, suppliers were notifying customers of increasing prices late in 2021," said Benchmark Mineral Intelligence (BMI) analyst Caspar Rawles.

HOW ARE NICKEL, COBALT AND LITHIUM USED?

EV batteries are charged and discharged by the flow of lithium ions between the graphite-containing anode and the cathode.

Cathodes contain nickel which delivers high energy density, allowing the vehicle to travel further.

Cobalt ensures cathodes do not easily overheat or catch fire and it helps extend the life of batteries which automakers usually guarantee for eight to 10 years.

HOW HAS CATHODE CHEMISTRY CHANGED?

Tesla batteries typically use nickel-cobalt-aluminium (NCA) but the dominant cathode chemistry in the auto sector is nickel-cobalt-manganese (NCM). The original ratio was 1-1-1.

Moves to include more nickel to boost energy density and extend driving range initially saw a shift to 5-3-2 and 6-2-2. Many automakers are now looking at 8-1-1.

LG Energy Solution is supplying batteries with cathodes containing 90% nickel to Tesla.

Volkswagen declined to comment on the ratio it uses but sources say its batteries use 7-1-2 cathodes.

Volkswagen said it likes lithium phosphate (LFP) batteries because they contain no cobalt or nickel and "supply is secure."

"LFP is robust over many charging cycles at lower cost," Volkswagen said. "We see potential to use LFP for up to 30% of our battery electric vehicle portfolio."

LFP costs significantly less to produce.

The driving range of LFP cars is lower, but they are popular in urban China, which dominates the EV battery supply chain.

BMI estimates cathodes can contain between 0-15 kg of cobalt, 0-40 kg of nickel and 30-50 kg of lithium.

WHY CUT COBALT?

One reason to cut cobalt content in EV batteries is cost - cobalt metal on the London Metal Exchange is trading at four-year highs around $71,000 a tonne.

Also, 50% of the world's cobalt reserves are in Democratic Republic of Congo where potential for political instability and disruption is high.

Congo currently produces more than 70% of the world's cobalt but some artisanal cobalt production poses reputational risk due to human rights abuses and the use of child labour.

WHAT ESG ISSUES RELATE TO NICKEL?

And nickel also has ESG (environmental, social and governance) risks.

Most new nickel units suitable for EV batteries will in future come from new high pressure acid leach (HPAL) plants in top producer Indonesia.

Indonesian nickel has a high carbon footprint and there are concerns the government will eventually give in to producers wanting to dump tailings in the sea.

Cobalt is a byproduct of nickel production in Indonesia.

Shortages of nickel have fuelled a rally that took prices to $24,435 a tonne last month, the highest since August 2011.

DOES LITHIUM ALSO HAVE ESG ISSUES?

Lithium mining also faces opposition from environmental and social activists.

Examples include Serbia's government halting Rio Tinto's Jadar project, which was expected to be Europe's biggest lithium mine, producing 58,000 tonnes a year of battery-grade lithium carbonate.

Deficits have pushed prices of lithium carbonate to record highs above $50,000 a tonne in China, according to BMI.

(Reporting by Pratima Desai Additional reporting by Victoria Waldersee and Heekyong Yang; Editing by Mark Potter)

Thanks for signing up to Minutehack alerts.

Brilliant editorials heading your way soon.

Okay, Thanks!