Hedge funds, pinning little hope on central banks' attempts to cool inflation, are spotting ways to profit from climbing interest rates.

How Big Hedge Funds Would Trade Sticky Inflation

Hedge funds, pinning little hope on central banks' attempts to cool inflation, are spotting ways to profit from climbing interest rates.

Data this week showed U.S consumer prices accelerated in January, pushing two-year Treasury yields to their highest since November as investors braced for inflation proving stickier than hoped.

Five prominent hedge funds shared five ideas using five different asset classes to profit from inflation so pugnacious it might force the Federal Reserve to keep interest rates higher for longer.

The ideas do not represent the trading positions of the firms, which cannot be revealed for regulatory reasons.

1/ GRAHAM CAPITAL MANAGEMENT

* Systematic and actively managed macroeconomic funds

* Size: $18 billion AUM

* Founded in 1994

* Key trade: U.S. Treasuries - Buy 2-year, sell 10-year

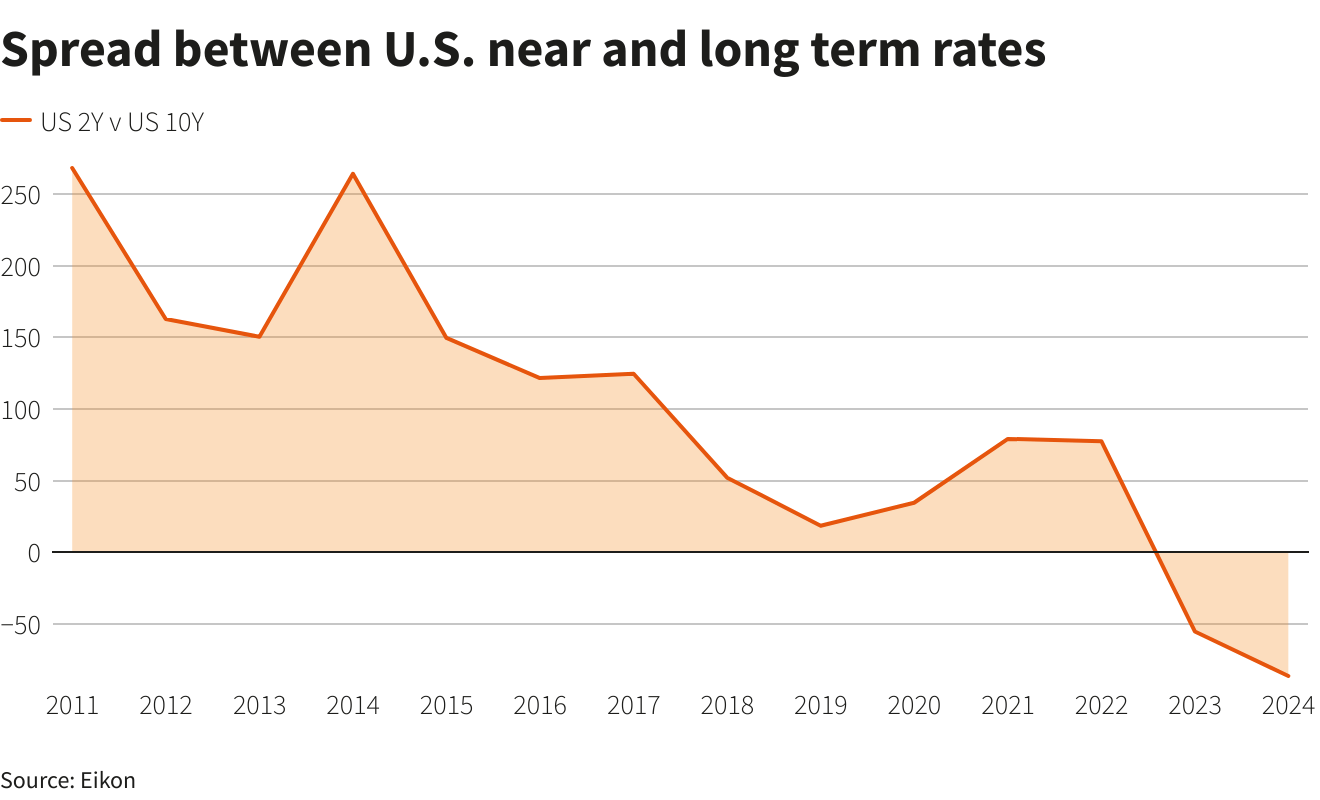

Ken Tropin, chairman and founder of Graham Capital, said if interest rates remain higher, then long-dated government bonds such as 10-year U.S. Treasuries, are too expensive compared to 2-year notes.

The U.S. yield curve, as measured by the gap between two and 10-year yields, is at its most inverted in decades in a sign of recession risk.

Based on what has happened in markets over the last two weeks, Tropin's trade idea would already be profitable but he believes it has further room to run.

2/ MAN GLG, a discretionary fund inside Man Group

* Actively managed

* Size: Man GLG is a $24.1 billion fund, part of the $138.4 billion Man Group as of end-Sept

* Man GLG was founded in 1995

* Key trade: Short unprofitable tech

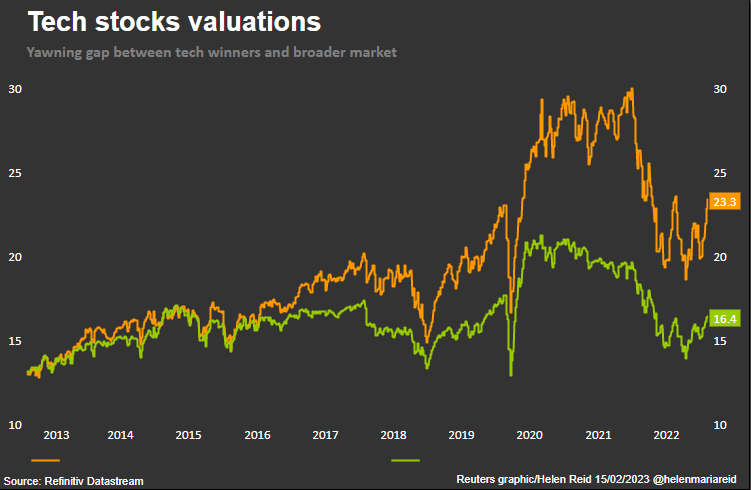

Ed Cole, managing director of discretionary investments at Man GLG, believes that eventually, inflation will fall sharply because earnings will fall and unemployment will rise.

Corners of the market where valuations have run the highest now face the sharpest reversal of fortune, said Cole.

Communications, consumer discretionary stocks (such as fashion brands) and tech companies have posted the best stock price performance against a backdrop of deteriorating earnings expectations, he said.

"If you have conviction that inflation will be stubborn, the opportunity for continued multiple contraction is significant, and being short these sectors, particularly in the more speculative parts – the non-profitable parts of tech – is attractive," said Cole.

3/ SCHONFELD STRATEGIC ADVISORS

* Multimanager across several strategies

* Size: $9 billion AUM

* Founded in 1988

* Sell interest rate futures

Colin Lancaster, global head of discretionary macro and fixed income at Schonfeld, favours selling interest rate futures based on the cost of borrowing in the Secured Overnight Financing Rate (SOFR), a benchmark interest rate.

Lancaster favours a trade selling long-term borrowing costs against shorter-term ones, on the view that the spread between them will decline.

"Concern now for markets is that reacceleration of the economy will lead to higher terminal rates," said Lancaster.

4/ GLOBAL CREDIT ADVISERS

* Founded in 2008

* Over $1 billion

* Key trade: Short high yield credit indices

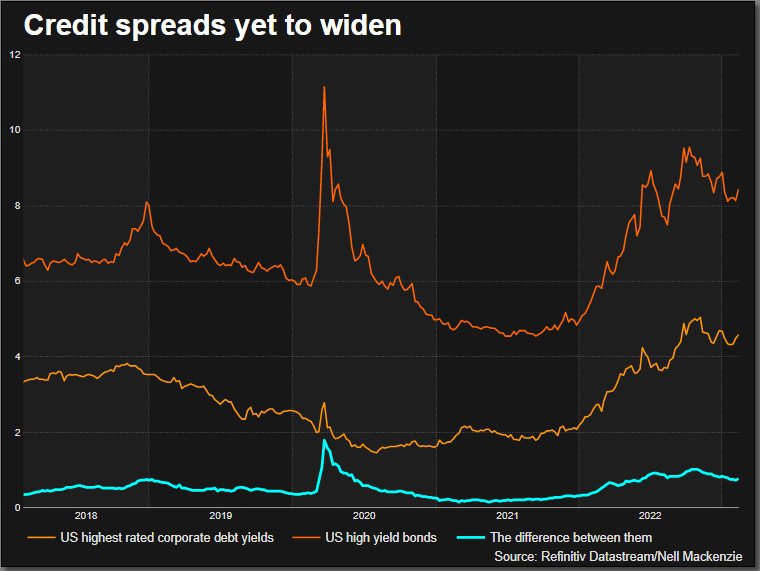

Brian Hessel, chief risk officer and COO at Global Credit Advisers, believes the pricing in of higher interest rates has not reached the riskiest parts of the corporate bond market.

He favours taking a short position, a bet that an asset price will weaken, on single name high yield credits or the indices that track the performance of these companies.

"If a soft landing is not properly engineered, defaults rise and liquidity events begin to happen, credit spreads will widen," said Hessel. Hessel says to avoid a short squeeze, the firm keeps a mixed portfolio of longs and shorts.

5/ THE MERCHANT COMMODITY FUND AT RCMA ASSET MANAGEMENT

* Manages the $300 million Merchant Commodity Fund

* Founded in 2004

* Key trade: Buy 2024/2025 U.S. natural gas futures

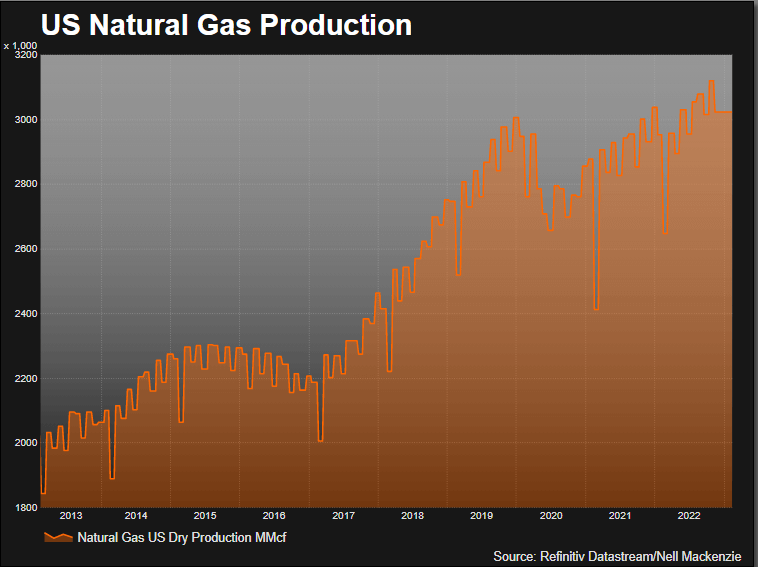

Doug King, chief executive officer at RCMA Asset Management, said Europe's mild winter has helped push gas prices down sharply. Energy prices surged after Russia's invasion of Ukraine last year, exacerbating inflation pressures, and forcing a global scramble to look for other sources of natural gas.

King believes that in the next few years, the United States, in order to meet its own domestic demand will increase its ability to meet the world's needs.

Buying U.S. long-dated natural gas futures for these reasons and also, he added, "in an inflationary cost/wage environment looks compelling."

(Reporting by Nell Mackenzie; editing by Dhara Ranasinghe and Toby Chopra)

Thanks for signing up to Minutehack alerts.

Brilliant editorials heading your way soon.

Okay, Thanks!