Moonpig Announces Plans For Stock Market Float

The greetings cards business has 12.2 million customers and sends 46 million cards a year.

Online greeting cards business Moonpig has unveiled plans for a stock market listing in a move expected to value the firm at more than £1 billion.

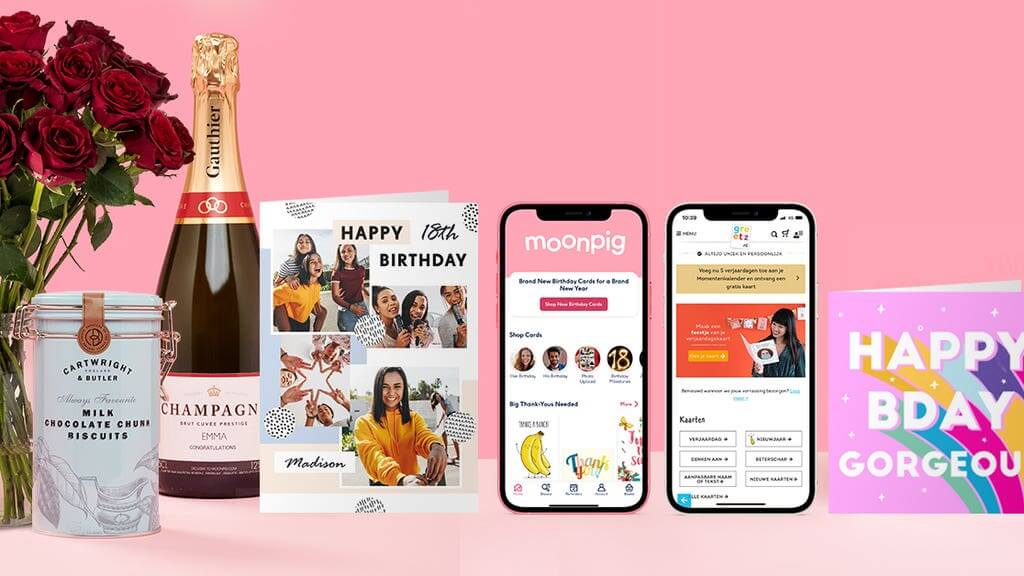

The group, which also owns Geetz in the Netherlands, is aiming to join London’s main market in what will mark the first significant listing of the year.

It comes after renowned footwear brand Dr Martens has also revealed it is gearing up for a possible flotation as firms look to take advantage of a bullish start to the year for stock markets.

Moonpig chairwoman and former WH Smith boss Kate Swann is helping oversee the potential listing, which is being planned to help the group capitalise on the surge in demand for online cards and gifts amid the pandemic.

The firm currently has 12.2 million customers and sends 46 million cards a year but is trying to position itself as a technology business, using customer data and predictive technology.

The cards and gifts market is worth £24 billion across the UK, Netherlands and Ireland, which is rapidly switching online.

Moonpig said only around 10% of card purchases were made online in 2019, which is forecast to double to 20% by 2021.

Moonpig Group chief executive Nickyl Raithatha said: “Moonpig Group’s mission is to create moments that matter, helping people to connect by sharing meaningful cards and gifts.

“This is more important now than perhaps ever before.

“We have built a technology platform that harnesses data-science and AI at every point of our customers’ journey, making it as effortless as possible for them to be as thoughtful as possible.”

Bosses hope harvesting customer data will help remind them of birthdays and cash in on additional gifts, including flowers – it is one of the UK’s top five florists.

The firm said the sale of gifts alongside cards – such as flowers, wine and chocolates – is “critical” to the group and is now almost half of the business.

It claims to be among the top five largest florists in the UK, sending out more than 200,000 bouquets of flowers for Mother’s Day.

The initial public offering (IPO) comes in the same month that rival Paperchase said it is looking at bringing in administrators due to plunging sales, putting 1,500 jobs at risk.

Moonpig by comparison has benefited from the lockdown, with families and friends turning to gifts and cards to help get through long periods without contact.

The group – backed by Exponent Private Equity Partners, which owns a 41.3% stake – has a 60% share of the online cards market in the UK and a 65% share in the Netherlands.

It made underlying earnings of £44.4 million in the year to April 30 on sales of £173.1 million, up 44% year-on-year.

In the half-year to October 31, it saw sales jump 135% to £155.9 million.

With the proceeds from the float, which will see at least 25% of its share capital available for trading, it aims to invest further in technology and staff, having hired 50 people during lockdown.

The group, which launched 20 years ago, has a team of more than 400 staff across the UK and Netherlands, with an office in London, a technology hub in Manchester and factory in Guernsey.

Thanks for signing up to Minutehack alerts.

Brilliant editorials heading your way soon.

Okay, Thanks!