OBR member Sir Charlie Bean said it was ‘almost completely impossible’ to predict the full economic impact of a no-deal Brexit.

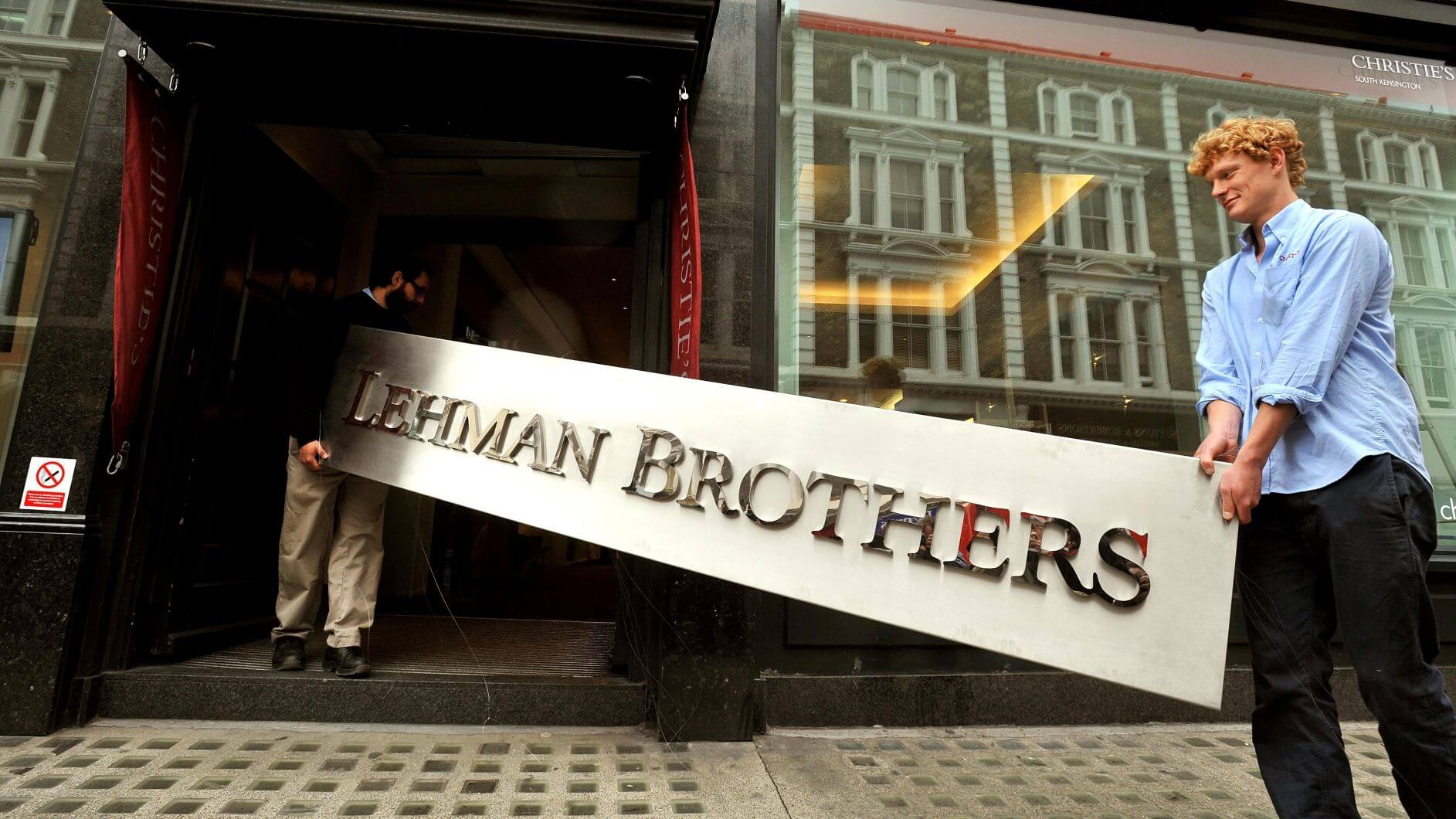

No-deal Brexit Like Lehman Brothers Collapse, Says Fiscal Watchdog

OBR member Sir Charlie Bean said it was ‘almost completely impossible’ to predict the full economic impact of a no-deal Brexit.

Britain’s fiscal watchdog has compared the shock of a no-deal Brexit to the collapse of Lehman Brothers that sparked the global financial crisis more than a decade ago.

Sir Charlie Bean, a member of the Office for Budget Responsibility (OBR), told MPs it was “almost completely impossible” to accurately predict the shockwaves that would be sent through the economy should the UK crash out of the EU without a deal.

He said that, as with the collapse of Lehmans in 2008, the actual havoc wrought by the shock would only become clear as events unfolded.

In a hearing with the Treasury Select Committee following the OBR’s Spring Statement forecasts, Sir Charlie said small businesses in particular were struggling to prepare for the various possible Brexit scenarios given that they do not have the management capacity or resources.

Sir Charlie – a former deputy governor of the Bank of England – also warned that uncertainty would continue to hold back business investment for several years, even in the event that a deal is struck.

He said: “The thing about these disruptive events is it’s easy to talk about in an abstract, but actually working out how they permeate through the economy is almost completely impossible.

“It’s exactly like the aftermath of the collapse of Lehmans, in many ways.

“A lot of the linkages you don’t realise until you’re actually living through it and in that sense there’s a limit to how much a business can do to prepare for it.”

Reiterating comments made by OBR chairman Robert Chote after last week’s Spring Statement by the Chancellor, the independent forecaster said the uncertainty that has reigned since the Brexit vote in 2016 will continue.

Sir Charlie said: “Even if you take some of the worst downside tail risks off the table, there’s still going to be some uncertainty.

“A more plausible story is that it (business investment) comes back over several years.”

Mr Chote added that securing a Brexit deal would only be the first stage, with many other factors such as trading relationships still to be ironed out.

“More and more of the pieces will be put in over time,” he added.

He said that a lengthy delay to Article 50 would prolong the uncertainty, if there was no sign of a firm deal at the end.

“The longer uncertainty persists, the weaker investment would be,” he said.

The OBR has not yet been asked to compile any forecasts for the economic impact of a no-deal Brexit, but said it stood ready should such a “fiscal event” arise.

But given that it may not have much notice, it may have to use a more “rough and ready” approach to its forecasting, according to Mr Chote.

He also took the opportunity to hit out at the Treasury for failing to give the OBR much notice for the Spring Statement.

It is usually required to give the watchdog 10 weeks’ notice of the date of the statement, but this year gave just six weeks’ notice.

Mr Chote said it “wasn’t ideal”, but conceded he realised these were “unusual circumstances”.

Holly Williams, Press Association Deputy City Editor.

Thanks for signing up to Minutehack alerts.

Brilliant editorials heading your way soon.

Okay, Thanks!