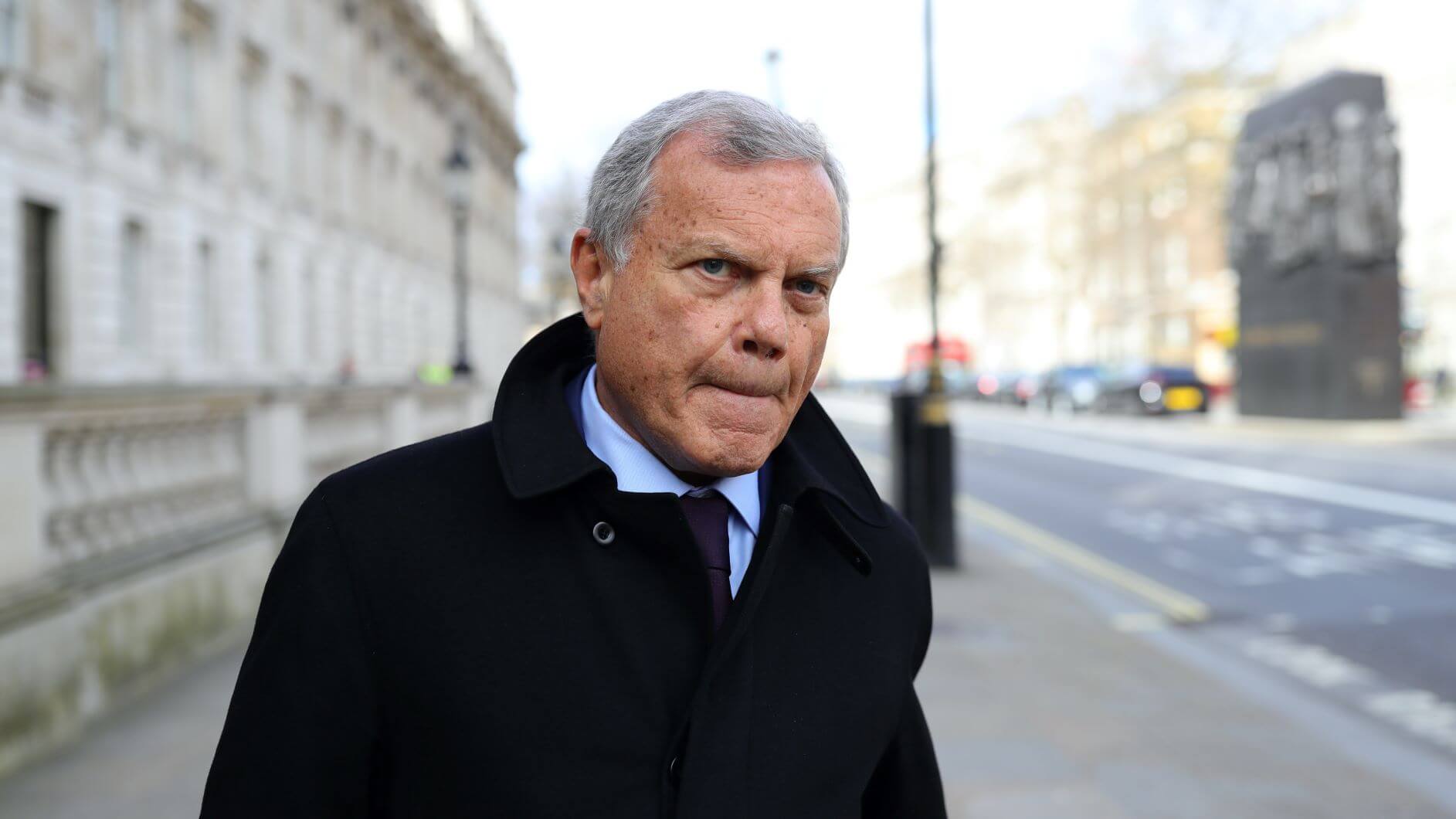

Shares in Sir Martin Sorrell’s ad firm rose after confirming preliminary discussions with rival MSQ Partners.

S4 Capital Confirms Early Merger Talks With MSQ Partners

Shares in Sir Martin Sorrell’s ad firm rose after confirming preliminary discussions with rival MSQ Partners.

Sir Martin Sorrell’s S4 Capital has confirmed it is in early talks over a potential merger with MSQ Partners, the creative agency group owned by private equity firm One Equity Partners.

The advertising company, founded by Sir Martin in 2018, said it had “received a proposal” to combine the two businesses but stressed that discussions are “at a very preliminary stage” and there is “no certainty” a deal will be agreed. Any transaction would see S4 acquire MSQ to create the combined group.

News of the talks sent S4 shares up 3.8% on Monday morning after reports over the weekend that MSQ had approached Sir Martin about a tie-up.

Sky News also reported that US firms Stagwell and New Mountain Capital have previously explored buying S4 or parts of it, but were rebuffed.

Sir Martin, who launched S4 after leaving WPP, expanded the business rapidly through a series of acquisitions, driving its valuation to around £5 billion in 2021. However, the firm’s market value has since fallen to about £140 million amid an advertising sector slowdown and the growing impact of artificial intelligence.

Thanks for signing up to Minutehack alerts.

Brilliant editorials heading your way soon.

Okay, Thanks!