Interest in the government's Enterprise Investment Scheme is at an all-time high because of the tax benefits it brings investors. How can your business benefit?

Enterprise Investment Scheme Interest Soaring On Tax Relief Announcement

Interest in the government's Enterprise Investment Scheme is at an all-time high because of the tax benefits it brings investors. How can your business benefit?

The Enterprise Investment Scheme (EIS) has existed since 1994 as a way to support new business growth by providing investment funds from other, more successful businesses and individuals.

In March this year, George Osborne announced tax relief changes which would affect EIS investors. The change focused on a marked decrease in Capital Gains Tax, making the profit made on any investment worth more. A 30% tax credit for EIS investments also added to the appeal of the scheme.

By investing in the EIS, businesses and individuals post-Budget-announcement would be able to make and save more money than they would have done before.

Interest in EIS since the Budget announcement

Data taken directly from Google shows the growing trend in people searching for EIS has grown significantly over time, with a marked spike in interest around the time of the announcement.

Interest in the term ‘EIS tax relief’ has also grown, as investors seek to learn more about how they can profit from the scheme.

Who benefits from EIS?

The beneficiaries of the Enterprise Investment Scheme fall into two main categories; small businesses (investees) and wealthier individuals/companies (investors).

Small businesses are able to access funding which may have otherwise been unavailable to them - even more so now that Osborne’s changes have ensured more profit and increased savings for investors. What were previously considered investments too risky to make are now satisfactory risks balanced out by greater potential rewards.

Wealthier individuals and companies are able to grow their own investment portfolio and support those businesses which are seeking to innovate and disrupt in their industries, thus aligning themselves with these types of companies. By making investment more appealing, Osborne hopes to further support new business growth, particularly amongst businesses which might otherwise be considered too ‘risky’ .

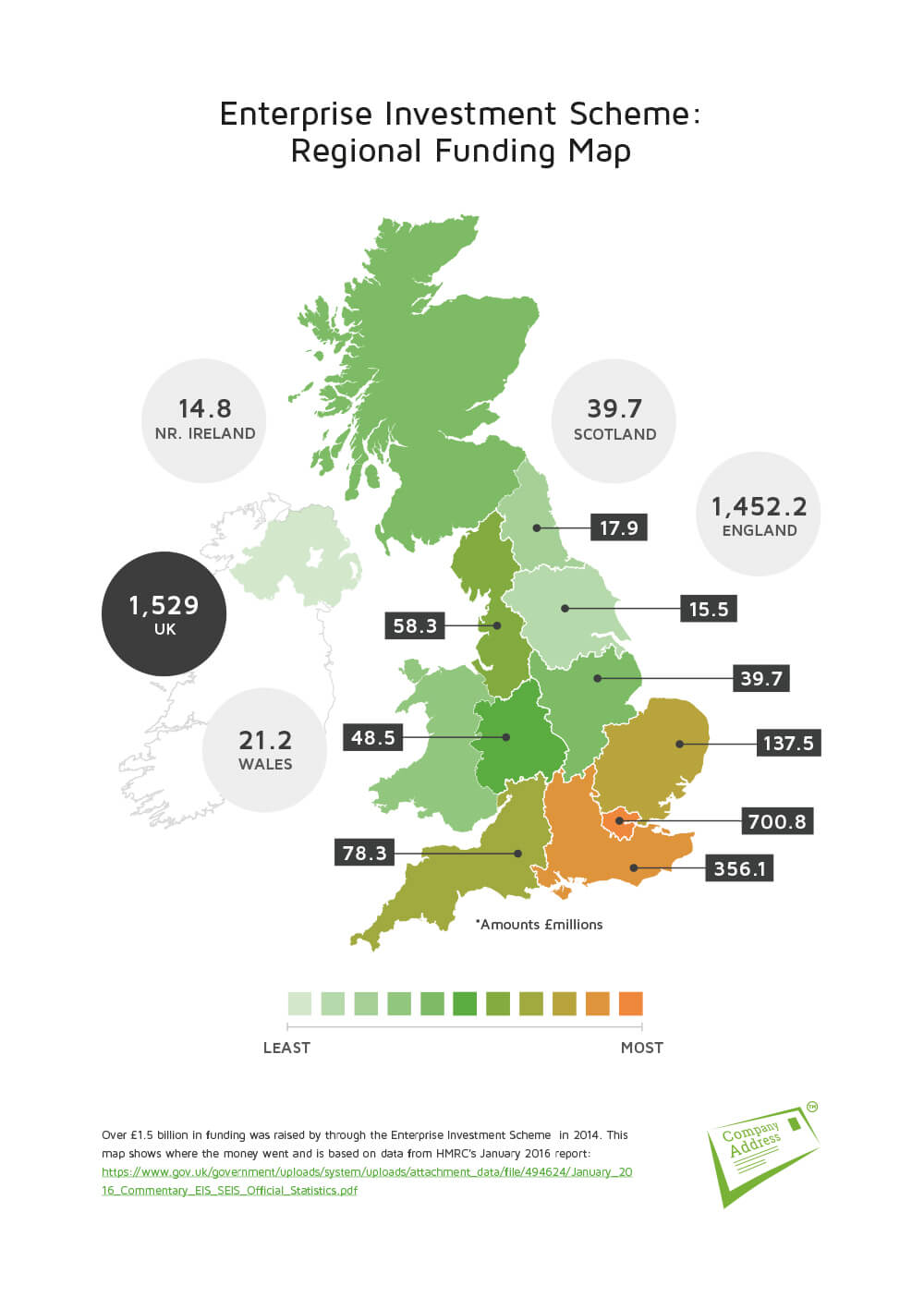

The government recently released data on the regional split of investments and the map below shows which areas of the country achieved investment in 2014:

The map shows that there was a significant level of investment in London, which may be expected given the level of business growth in that area. The North West is also notable in this map, having received a higher level of investment than the surrounding northern areas. It’s interesting to see the spread of investment, with startups throughout the UK seeking support through the scheme.

Indeed, data from business information site Company Check shows that London had the highest rate of new business incorporation in the period between 2010-2014, but that areas such as Scotland and the North are growing quickly. The latest updates to EIS may well see investments increase in these areas too.

How to apply for EIS funding

EIS funding is available to all businesses which fulfil the eligibility criteria laid out on the HMRC website and the Enterprise Investment Association.

You can also find out more about equity funding in general here.

Since its inception, the EIS has helped thousands of businesses in the UK to grow through investment, and investors to contribute to that small business growth by putting their money into exciting new companies. £1.6 billion was raised by small businesses between 2013 and 2014 in the Scheme, a number set to grow significantly this year.

David Weiner is business development manager at Company Address.

Thanks for signing up to Minutehack alerts.

Brilliant editorials heading your way soon.

Okay, Thanks!