Post-Brexit Employment: Everything You Need To Know

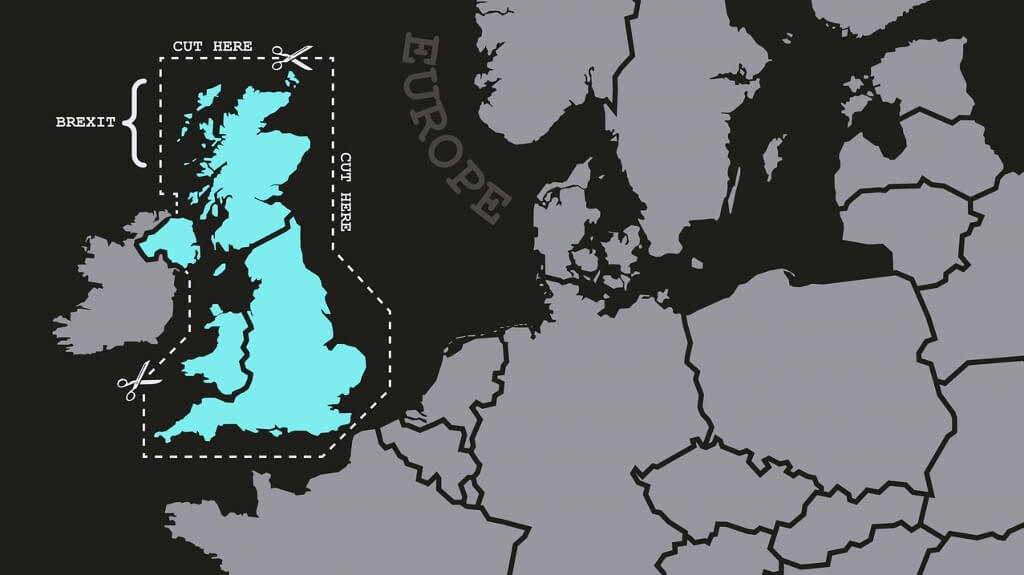

Brexit is coming. What can you do to ensure business growth after Britain exits the EU?

If you are a UK employer then it’s likely you are concerned about the fallout of Brexit, particularly in relation to how you expand in Europe and how you best employ Brits abroad and EU nationals at home.

The UK’s decision to leave the European Union (EU) has caused a lot of uncertainty over the country’s future – and, of course, businesses and the stock markets notoriously hate uncertainty. For example, the tech sector risks losing £1.7 billion of its export revenues if the government takes the UK out of the EU with no trade deal, according to latest reports.

It’s hardly surprising that, according to a recent survey of 357 companies conducted by the Confederation of British Industry, over two fifths said that Brexit was already having a negative impact on investment decisions.

This high level of uncertainty is based on many things, not least the fact that the Governor of the Bank of England has recently warned that Brexit is expected to lead to a weaker economy, higher inflation, higher interest rates and higher wages.

Additionally, and of most importance to fast-growing British businesses who want to employ the best skilled workers across Europe and the rest of the world, Brexit is also threatening the end of freedom of movement, all of which will make it increasingly difficult for organisations to set up shop and expand into other EU countries.

There are a few key things that UK employers need to know about workforce expansion in Europe post-Brexit, but many are either too afraid to ask, or simply oblivious to any issues they are about to run into.

Being clued-up about global employment and workforce expansion in a post-Brexit age is vital, as UK businesses look to operate in what can be a very fragmented global landscape.

Brexit challenges, pitfalls and solutions

There are a few need-to-know solutions that are available to businesses to help them overcome the uncertainty they face and get it right when it comes to successfully expanding their operations into Europe post-Brexit.

Firstly, it’s important to know that setting up shop in different European countries comes with different challenges in each territory. There are, for example, country specific nuances of setting up businesses in particular countries like Ireland, Spain and Germany, as well as non-EU European countries such as Switzerland.

Around 44 per cent of UK exports in goods and services are currently sold to other EU countries. In monetary terms, that’s around £240 billion in value, out of a total export figure of £550 billion. So it’s pretty vital that British businesses continue to trade with the EU, our largest trading partner by a considerable margin.

When considering employing full-time staff or contractors in an EU country, you are initially going to have to negotiate a few added complexities thrown up by different tariff barriers and compliance with local regulations and standards.

The end of the EU’s freedom of movement is also going to mean that Brits employed abroad in continental Europe or EU nationals employed at home are going to need work visas. So how is this going to impact on your business in terms of potential skills gaps?

It is, of course, important that you are able to find the best skilled workers to enable your business to grow and flourish. Yet what happens when you face a potential skills crisis due to being unable to find the correctly-skilled workers?

Staff might not be so easy to come by next year

Continental outposts

When setting up businesses abroad, it is the unexpected costs which often surprises British firms, especially if it’s their first time doing so. You need to know the ins and outs of local employment laws, and, as an employer, you need to be fully aware of what needs to be included in an employment contract to comply with domestic legislation.

For example, here are a few of the key country-specific differences that British employers need to know when looking to expand into Europe:

GERMANY

For employment and payroll purposes, registrations with tax and social security authorities are required. Employee earnings are subject to withholdings for social security (19.425 per cent employer and employee portion each, up to a ceiling of €6,350 gross per month) and wage tax (from 14 per cent to 45per cent) to be done through payroll.

IRELAND

Employers are required to pay a universal social charge (up to 8 per cent) and Pay Related Social Insurance (up to 10.75 per cent for the employer and 4 per cent for the employee).

SWEDEN

Social charges vary according to canton and employer’s chosen pension fund scheme. Employer’s contributions have to be paid in addition to the gross salary, at approx. 12-20 per cent of the gross salary. Employee’s contributions have to be deducted from the employee’s gross salary at approximately 10-17 per cent of the gross salary.

SPAIN

In general, employees receive their annual salary in 14 payments (12 for each month, with additional payments in June and December).

The benefits of using an Employer of Record service

It’s time to accept that dealing with these country-specific employment issues is vital to British employers if they are to avoid the much-vaunted ‘Brexit brain drain’.

One recent survey, for example, claimed that as many as one million EU nationals working in the UK are already considering leaving the country. Which indicates that retaining the best talent and finding new talent in Europe is going to be a massive challenge for British business.

Any UK-based firms with plans for global expansion will need to consider the following:

- What happens to employees abroad?

- How do we prepare for the unknown and be compliant with any employment regulations?

- Is it going to be an excessive cost to set up a legal entity on the continent, or in Ireland, in order to continue our operations there?

To deal with these unknowns, the best solution by far is to make use of an agile and comprehensive Employer of Record (EOR) service.

Post-Brexit ‘talent mobility’ is a challenge on an incredibly large scale, with around 3.6 million EU nationals currently living in the UK, and 4.5 million Brits living in continental Europe.

Preparing for any eventuality by employing an EOR service is a cost-effective and straightforward way of managing the risk and uncertainty associated with post-Brexit talent and staffing concerns.

It pays to stay on the right side of employment law - wherever you are

What is an EOR?

Put simply, an EOR service assumes all the key business of employment responsibilities such as HR, payroll and benefits and, with the current uncertainty mentioned above, can easily be set up to help to mitigate the effects of Brexit.

It helps companies retain the best talent possible, no matter where those workers are based. An EOR can deal with the sponsorship of employee residency VISAs and work permits, for example, taking away the onus and responsibility from the worker or his or her employer to deal with such complex and costly bureaucracy.

An EOR ensures that all your staff are paid on time, receive all the relevant employee benefits and can be managed just as well as if they were in the same office.

All of which frees you up to concentrate on running your day-to-day business, and saves you valuable time and resources that would otherwise be spent figuring out the complex ins and outs of setting up a legal business in the country in which you want to do business.

With an EOR, you can have workers up and running within two days, for example, as opposed to having to wait months to set up a new subsidiary. It’s also a flexible way of testing out the water in new markets.

All in, using a good EOR service is a reliable and inexpensive way of dealing with any planned expansion into Europe in a post-Brexit age.

Rick Hamell is CEO of Elements Global Services.

Thanks for signing up to Minutehack alerts.

Brilliant editorials heading your way soon.

Okay, Thanks!