One in 10 businesses were sued by councils over the past year for failing to cope with tax increases, according to real estate adviser Altus Group.

Councils Sue 750 Firms Struggling With Soaring Business Rates Each Day

One in 10 businesses were sued by councils over the past year for failing to cope with tax increases, according to real estate adviser Altus Group.

Councils have sued 750 shops, pubs and other firms each day for struggling to pay soaring business rates, new data has revealed.

Around one in 10 businesses were sued by their local councils over the past year for failing to cope with the ever-increasing tax burden, according to real estate adviser Altus Group.

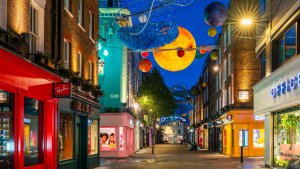

Shops, pubs, restaurants and offices have called for cuts to rates, with high streets up and down the country decimated by surging business rates, rent prices and a slump in customer confidence.

The real estate group said the figures highlight the cost pressures on UK businesses, as around 190,000 business premises were hauled to court over the non-payment of rates during the last financial year.

The data revealed that 9.8% of all non-domestic premises were issued summons by local councils over business rates arrears.

During the year to March 2019, businesses in Richmond & Wandsworth council areas were worst affected, with more than a quarter of firms taken to magistrates’ court.

The second worst affected area was Labour leader and MP Jeremy Corbyn’s Islington borough, where 23.3% of firms were sued for failure to pay rates.

Some firms in Middlesbrough, Liverpool and Bracknell also particularly struggled to meet business rate payments.

Urban areas were issued with the most summons in total, with Westminster, Birmingham, Manchester, Liverpool and Leeds seeing the highest number of firms taken to court.

Robert Hayton, head of UK business rates at Altus, said the Government’s reliance on property for tax revenues is too great.

He said: “With 1,255,800 of non-domestic premises actually having rates liabilities to pay, almost one in every six with an actual bill received a summons to appear before a magistrate during the last year.”

Mr Hayton added that a “tax stimulus is desperately needed” to address the issue.

He said: “Major retail and hospitality businesses were reducing their estates and headcount, often citing high level of rates as a contributory factor, whilst other sectors, such as manufacturing, were hurting too.”

The situation could also significantly worsen over the next year, the group said, after businesses were struck with a further increase to business rates in April.

The standard rate of tax, which applies to all medium and large premises in England with a rateable value over £51,000, rose by 2.4% to 50.4p for the current financial year.

Large numbers of firms were struck with summons, even though more than a third of premises had no bill to pay at all due to changes in small business rates relief.

A Government spokesman said ministers are committed to assisting small businesses on the high street and are cutting business rates by £13 billion over the next five years.

“Our £3.6 billion towns fund announced by the Prime Minister last month will support towns and town centres, allowing them to attract greater footfall, jobs and investment,” he added.

“This includes making £1 billion available as part of the future high streets fund to directly help high streets adapt to the changes we are seeing in shopping habits.”

Henry Saker-Clark is PA City Reporter.

Thanks for signing up to Minutehack alerts.

Brilliant editorials heading your way soon.

Okay, Thanks!