Inflation Holds Steady As Lower Food Prices Offset Higher Fuel Costs

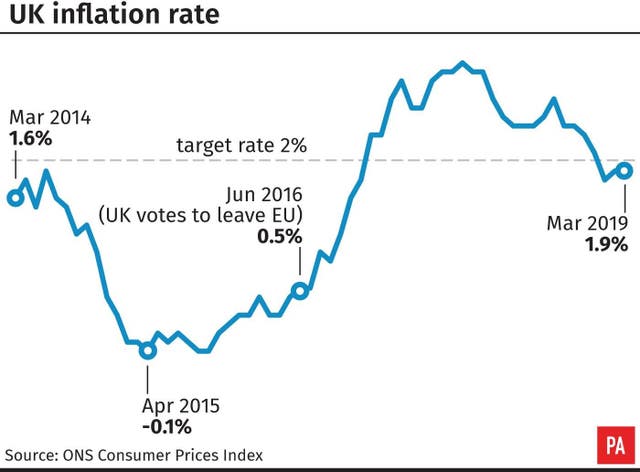

The Consumer Prices Index (CPI) was unchanged at 1.9%.

Inflation was flat in March, as lower food prices offset higher fuel costs at the pumps.

Figures from the Office for National Statistics (ONS) show the Consumer Prices Index (CPI) was unchanged at 1.9% last month, matching February’s rate.

March inflation missed economists’ expectations of 2%, which would have put it squarely in line with the Bank of England’s target.

Mike Hardie, head of inflation at the ONS, said: “Inflation is stable, with motor fuel prices as well as the cost of computer games growing more slowly than it did at this time last year.”

Drivers faced higher costs for fuel, with average petrol prices up by 1.2p per litre to 120.3p. Diesel rose 1.4p per litre to 130.7p.

But computer games weighed on the recreation and culture category, with prices growing at a slower rate than the previous year.

Commenting on today’s inflation figures, Mike Hardie Head of Inflation said https://t.co/pe4pADwnmM pic.twitter.com/iwJ5Af7wke

— ONS (@ONS) April 17, 2019

Games toys and hobbies, the category which includes computer games, rose 1% on the month, compared to a 3% rise in March of last year.

The ONS measures the prices of top-selling video games of each month, meaning new releases can affect the overall impact of the category.

Recording media, which includes CDs and DVDs, also weighed on recreation and culture. Prices fell 3.5% between February and March but were up 2.1% during the same period of 2018.

Costs of food and non-alcoholic beverages also held CPI back from rising.

Oils and fats had the most significant effect as prices slipped 1.4% in March, in contrast to last year’s rise of 6.7%.

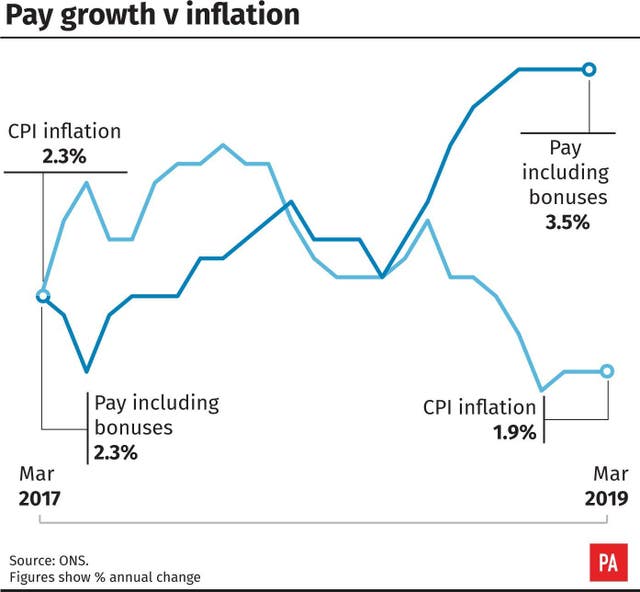

Commenting on the stable rate, EY Item Club’s chief economic adviser Howard Archer said: “This is helpful news for consumer purchasing power and facilitates the Bank of England keeping interest rates unchanged at 0.75% as Brexit uncertainties are extended.

“Any help to consumer purchasing power is particularly welcome as the economy is likely to be hampered by prolonged Brexit uncertainties following the flexible extension of the UK’s exit from the EU to 31 October.”

Factory gate inflation rose 2.4% on the year to March 2019, unchanged from February 2019 https://t.co/trP2BOwlw9 pic.twitter.com/9UkiLZX47f

— ONS (@ONS) April 17, 2019

The CPI, including owner-occupiers’ housing costs (CPIH) – the ONS’s preferred measure of inflation – was 1.8% in March, unchanged from February.

The Retail Prices Index (RPI), a separate measure of inflation, was unchanged from February at 2.4%.

Yael Selfin, chief economist at KPMG, said: “The figures will offer some comfort for businesses worried about the extra costs associated with the departure from the EU, as well as the prospects of rising costs of capital.”

Thanks for signing up to Minutehack alerts.

Brilliant editorials heading your way soon.

Okay, Thanks!