The Treasury Select Committee called for changes to ensure that self-employed people could get better financial support.

Lay Out Criteria For Ending Restrictions, MPs Tell Government

The Treasury Select Committee called for changes to ensure that self-employed people could get better financial support.

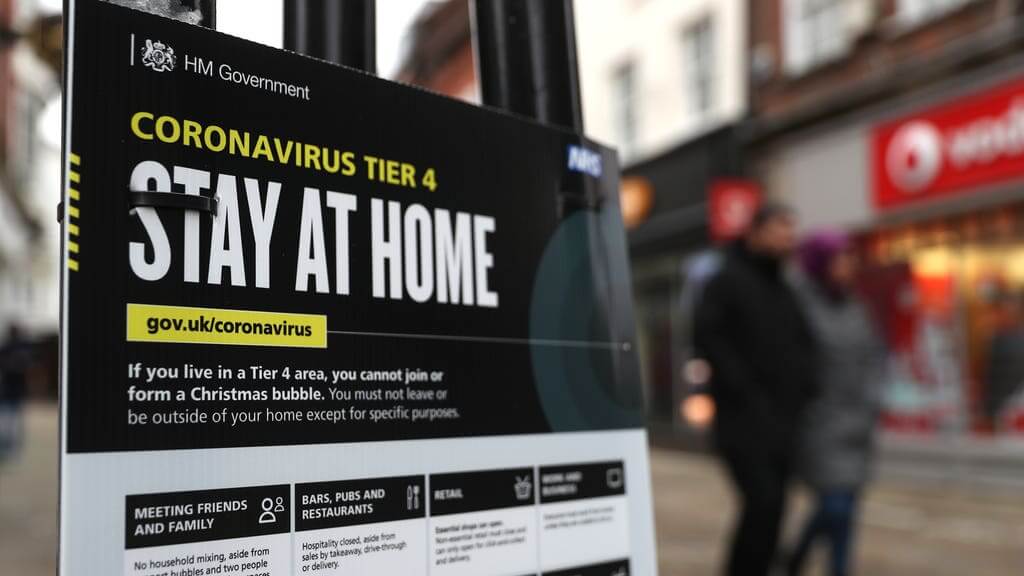

An influential group of MPs from across party lines have called on the Government to lay out clear criteria for when restrictions will be lifted and plug gaps in its support schemes.

The Treasury Select Committee said that the Government’s “plan for taking the country out of lockdown”, which will be released next week, should say how and when restrictions will be lifted to give confidence to people and businesses.

It added that a lack of analysis from the Treasury on the implications of social restrictions was “disappointing.”

“After almost a year of restrictions, people and businesses need confidence that the Government has a clear route out of the crisis,” said the committee’s chair Mel Stride.

“To provide this confidence, the Government must set out the criteria for how and when it will lift lockdown restrictions.

“This should be supported by combined economic and epidemiological modelling undertaken by the Treasury, showing how it would best optimise health and economic outcomes.”

In a report published on Monday into the economic impact of Covid-19, the Treasury Select Committee also asked for Government to address the “hard edges” of its support measures for self-employed people.

Self-employed company directors who pay themselves largely in dividends have lost out, as have some who became self-employed after the cut-off date.

To be eligible for financial support, self-employed people must have traded during the financial years ending in 2019 and 2020 and submitted a self-assessment tax return for the former before April last year.

This can be remedied by using newer tax returns to let people apply for the Self-Employment Income Support Scheme (SEISS), the committee said.

It also suggested that the Government reconsider the threshold for the scheme so that people who get less than half their income from self-employment can get some support.

“Nearly a year on from when the Government first introduced coronavirus support schemes, those who have been excluded must not be forgotten,” Mr Stride said.

“New data from the 19-20 tax returns should be used to help the newly self-employed for the fourth tranche of the SEISS grant.

“We have also made recommendations for how the Treasury should help those limited company directors and freelancers that have fallen through the gaps in support.”

The Treasury said: “The PM has said that we’ll set out a clear roadmap out of the current restrictions with dates later in February.

“Throughout this crisis, we have done all we can to support jobs and livelihoods, spending over £280 billion in response to the pandemic.

“We acknowledge that it has not been possible to support everyone in the way they might want, but we continue to keep our schemes under review and will set out the next stage of economic support at budget.”

Thanks for signing up to Minutehack alerts.

Brilliant editorials heading your way soon.

Okay, Thanks!