The British Business Bank has handed out loans worth £151m to northern start-ups since 2012, compared with £128m in the capital.

More Government-Backed Loans Handed To Entrepreneurs In North Than London

The British Business Bank has handed out loans worth £151m to northern start-ups since 2012, compared with £128m in the capital.

More loans were handed out to entrepreneurs in the north of England from the Government-backed British Business Bank than their rivals in London, new figures reveal.

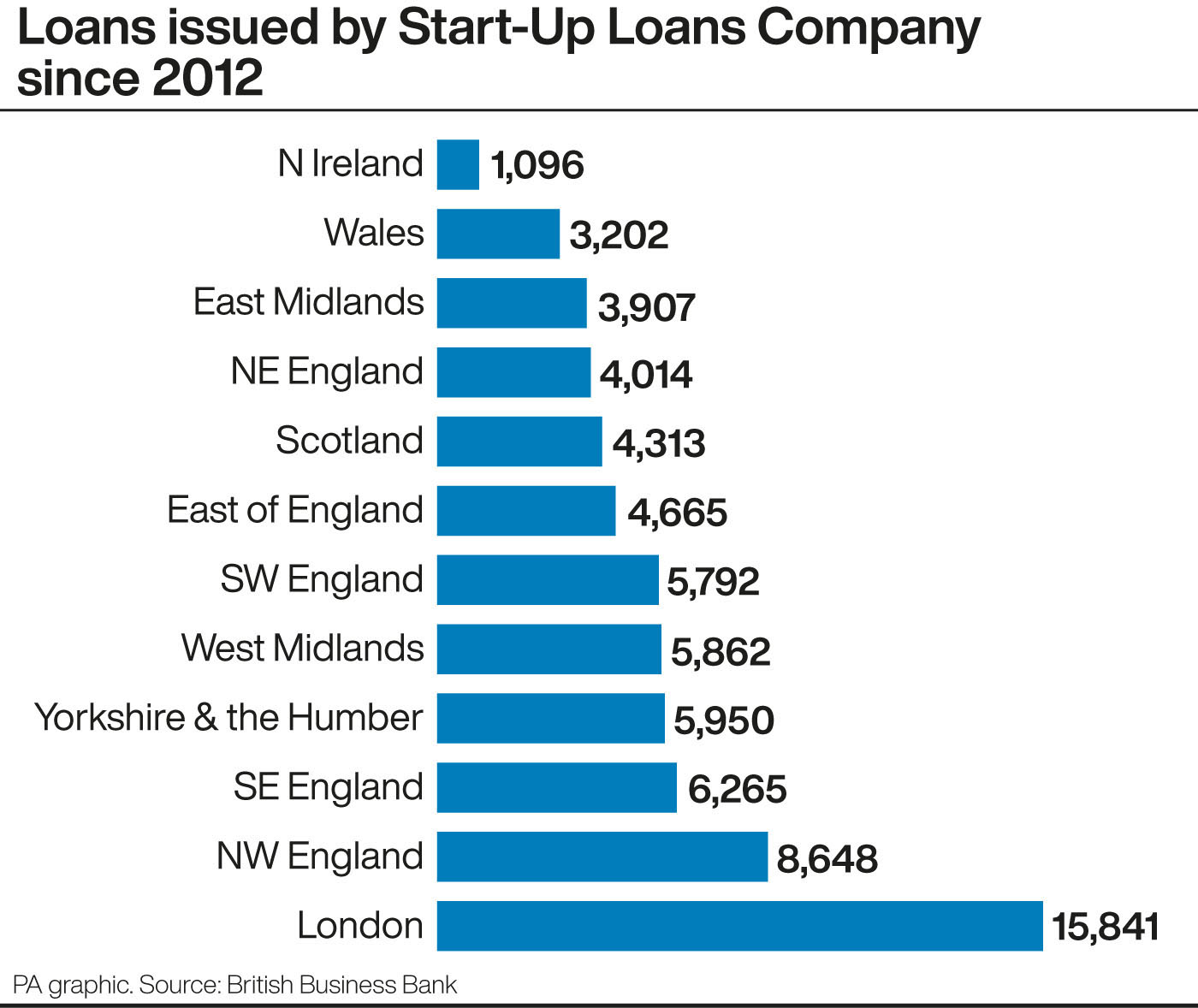

Since launching in 2012, the bank has loaned £151 million through its Start Up Loans programme, to 18,612 small businesses based in the North East, North West and Yorkshire and Humber regions.

By comparison, London-based start-ups were given loans of £128 million across 15,841 businesses, with an average loan of £8,126.

The Government is keen to highlight the work it is doing in the north of England following the recent general election, which saw swathes of traditional Labour voters switch to the Tories.

In 2019 alone, the Start Up Loans programme lent £25 million in funding to help 2,355 people in the North to start a business.

Kelly Tolhurst MP, the minister for small business, said: “We need entrepreneurs to unleash Britain’s potential.

“This Government is backing businesses right across the northern region and is determined to level up every part of the UK. Start Up Loans make it possible for even more people to get the funding they need to turn their business ideas into reality.”

One businessman to have benefitted from the loan scheme is Ryan Bailey, co-founder of Northern Monkey Brew in Bolton.

Mr Bailey set up his business in 2016 with a £25,000 loan and now sells 30 different beers and opened a bar and brewery in the town.

He said: “It’s been an absolute dream come true to launch the brewery with my friend and business partner Liam. It started off as just a hobby as we both liked good beer, but now we supply to pubs across Bolton.

“It’s hard to believe how far we’ve come, and we are incredibly grateful to Start Up Loans for giving us the support and advice we needed to get started.”

The business bank was set up in 2012 by the coalition Government with initial funding of £1 billion promised.

Ministers launched the scheme to offer loans to businesses who may struggle to get access to finance through traditional means, by acting as guarantors on loans and providing expertise and support.

Simon Neville is PA City Editor.

Thanks for signing up to Minutehack alerts.

Brilliant editorials heading your way soon.

Okay, Thanks!