UK Banking App Revolut Seeks Australian Banking Licence

Revolut is one of the world's most valuable fintechs.

British-based digital banking app Revolut is seeking a banking licence in Australia and is engaged in talks with the country's regulator to be allowed to take customer deposits, country head Matt Baxby said on Friday.

Revolut, one of the most valuable fintech so-called unicorns worldwide, last year obtained a financial licence for its subsidiary in Australia and is registered with the anti-money-laundering agency as digital exchange, the company said.

"Our mission is to directly challenge the incumbent banks that ... offer a suboptimal user experience, and their business models are really quite reliant on customer apathy," Baxby told a parliamentary committee.

"We've engaged with APRA (Australian Prudential Regulation Authority) and are intent on filing an application to become an Aussie bank."

Australia's banking system is dominated by four banks that control about 80% of the sector - Commonwealth Bank of Australia, Westpac Banking Corp, Australia and New Zealand Banking Group and National Australia Bank.

In recent years, a number of so-called challenger banks have emerged but some have been taken over by the big incumbents while others have failed, prompting the regulator to toughen its licensing rules.

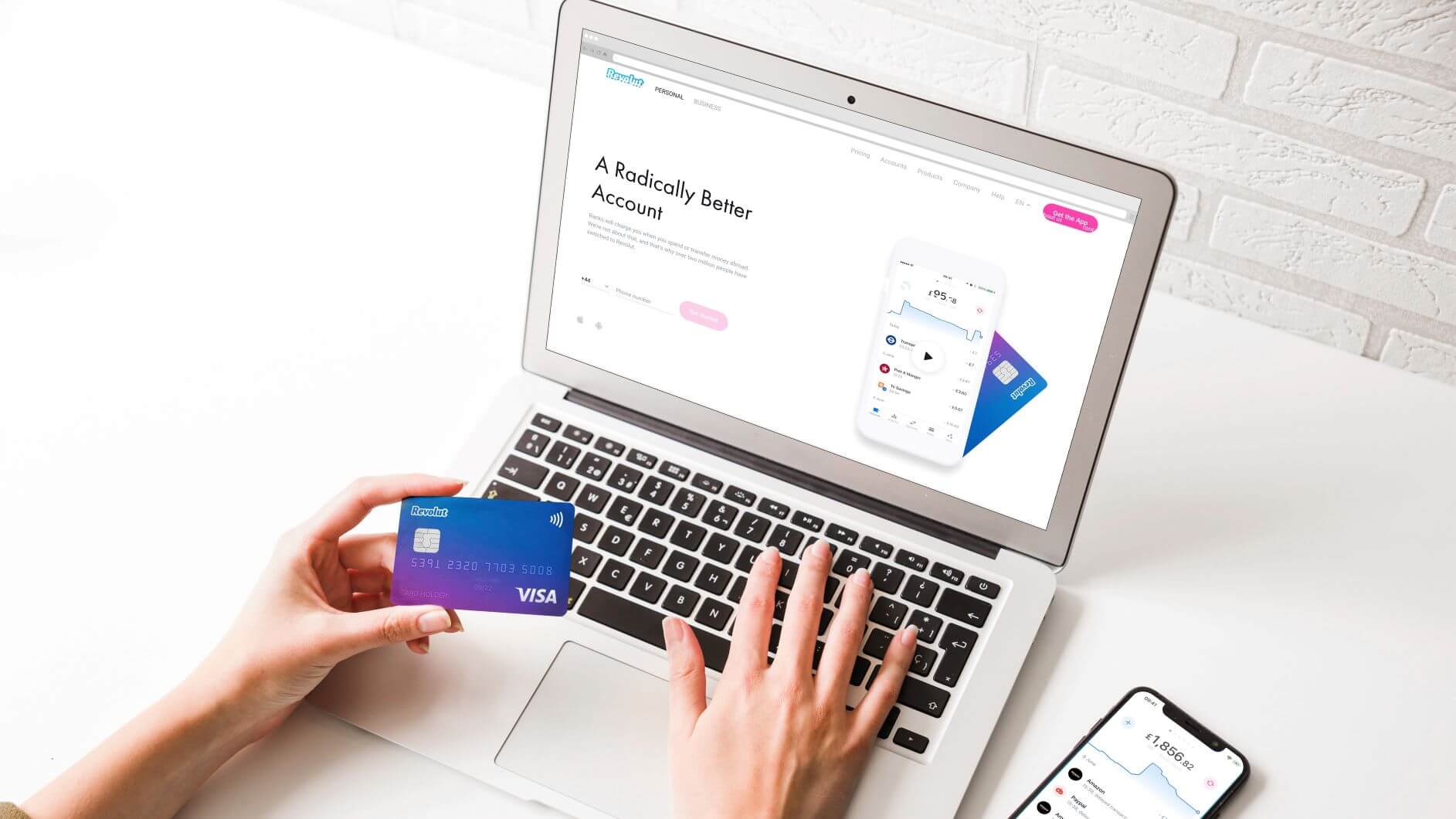

Established in 2015, Revolut has more than 16 million customers and is aiming to become a leading financial super app.

It has gained popularity with travellers by offering cheaper and easier foreign exchange services than mainstream banks and now provides a range of products including trading and insurance. It has yet to become profitable.

Since launching in Australia last year, over 100,000 people have signed for services including pre-paid card payments, foreign exchange and crypto trading, Baxby said.

Its local team has grown from three to 25 staff.

(Reporting by Paulina Duran in Sydney; Editing by Tomasz Janowski).

Thanks for signing up to Minutehack alerts.

Brilliant editorials heading your way soon.

Okay, Thanks!