UK Businesses Keep Up Recovery But Prices Still A Worry, PMI Shows

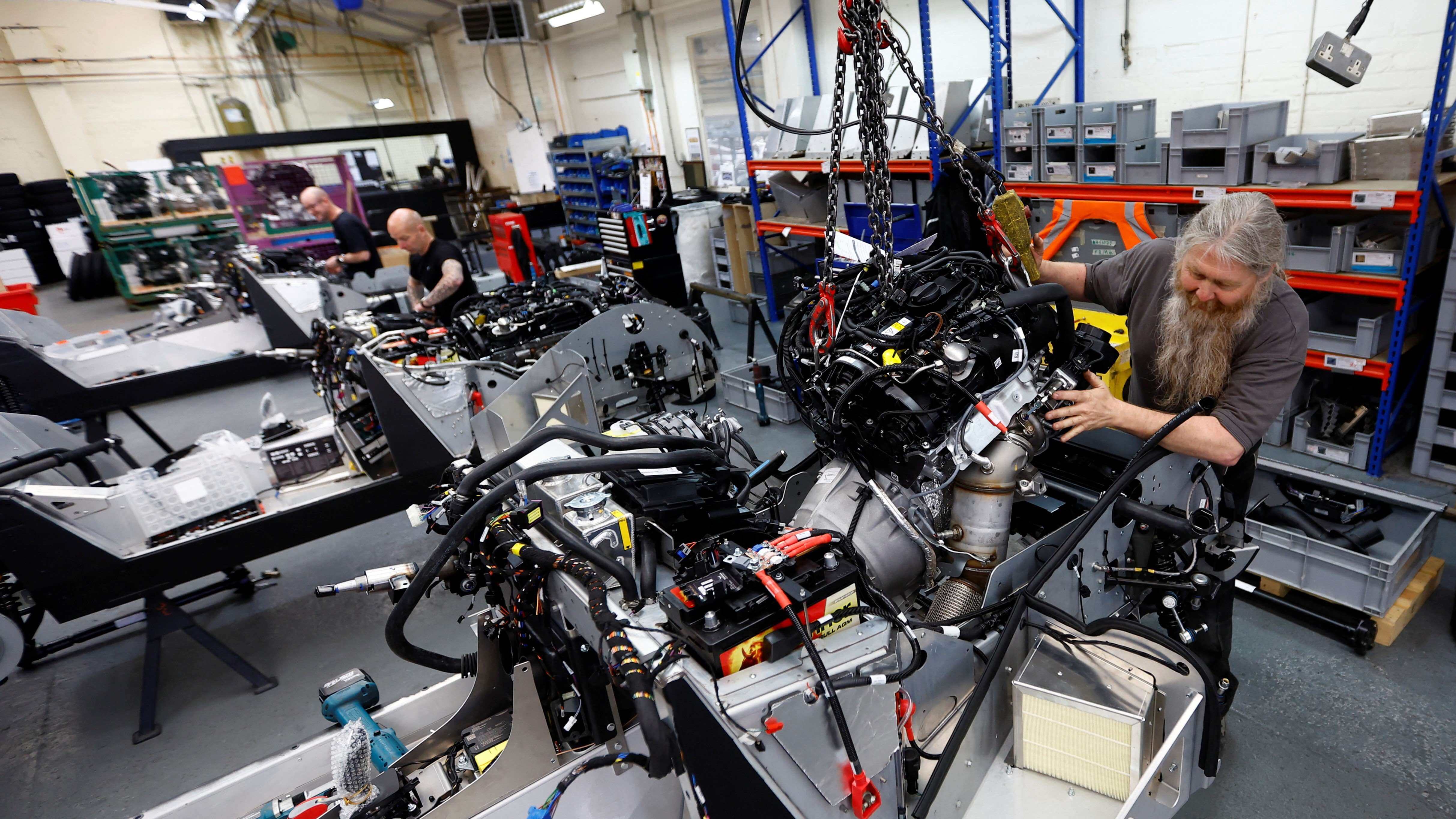

The manufacturing sector came within a whisker of ending its 20-month downturn in March.

British businesses kept up their recovery from recession this month but stubborn price pressures could bolster the Bank of England's wait-and-see approach to interest rates, a survey showed Thursday.

Closely watched by the BoE ahead of its 1200 GMT interest rate decision, the S&P Global Composite Purchasing Managers' Index (PMI) inched down to 52.9 in March from 53.0 in February.

Despite the slight fall, the index notched up a fifth month above the 50 threshold for growth and signalled Britain is on track to exit the shallow recession it entered in the second half of last year.

Survey compiler S&P Global said economic output was likely to expand around 0.25% in the first quarter, based on the PMI's previous track record, similar to the consensus of 0.2% among economists polled by Reuters.

"Further signs of the UK economy having pulled out of last year's brief recession are provided by the provisional PMI data for March," Chris Williamson, chief business economist of S&P Global Market Intelligence.

The composite PMI - which BoE officials had access to ahead of their rate decision - showed no sign of a further rapid easing of inflation pressure.

While its gauge of input prices eased back slightly from February's six-month high, for selling prices it rose to the highest level since July 2023.

"March's PMI warns of elevated underlying price pressures which will likely add to calls for restraint in any pivot to lower interest rates until there are firm signs of lower wage growth," Williamson said.

Official data on Wednesday showed consumer price inflation fell to 3.4% in February from 4.0% in January, the lowest reading since September 2021. While slowing, services inflation remains stubbornly high.

The PMI for the services sector fell to 53.4 in March from 53.8 in February, a three-month low and against expectations for an unchanged reading. Its measures of employment and new orders cooled, the latter reaching the lowest since November.

The manufacturing sector came within a whisker of ending its 20-month downturn in March. The factory PMI rose to 49.9 - just below the 50 no-change mark - from 47.5, while output turned positive for the first time in more than a year.

However, the survey's gauges of industrial input costs hit a 1-year high, while selling prices rose at the fastest rate since May.

(Reporting by Andy Bruce; Editing by Toby Chopra)

Thanks for signing up to Minutehack alerts.

Brilliant editorials heading your way soon.

Okay, Thanks!