Manufacturing output is still falling, but the pace of decline has moderated, according to the latest CBI data.

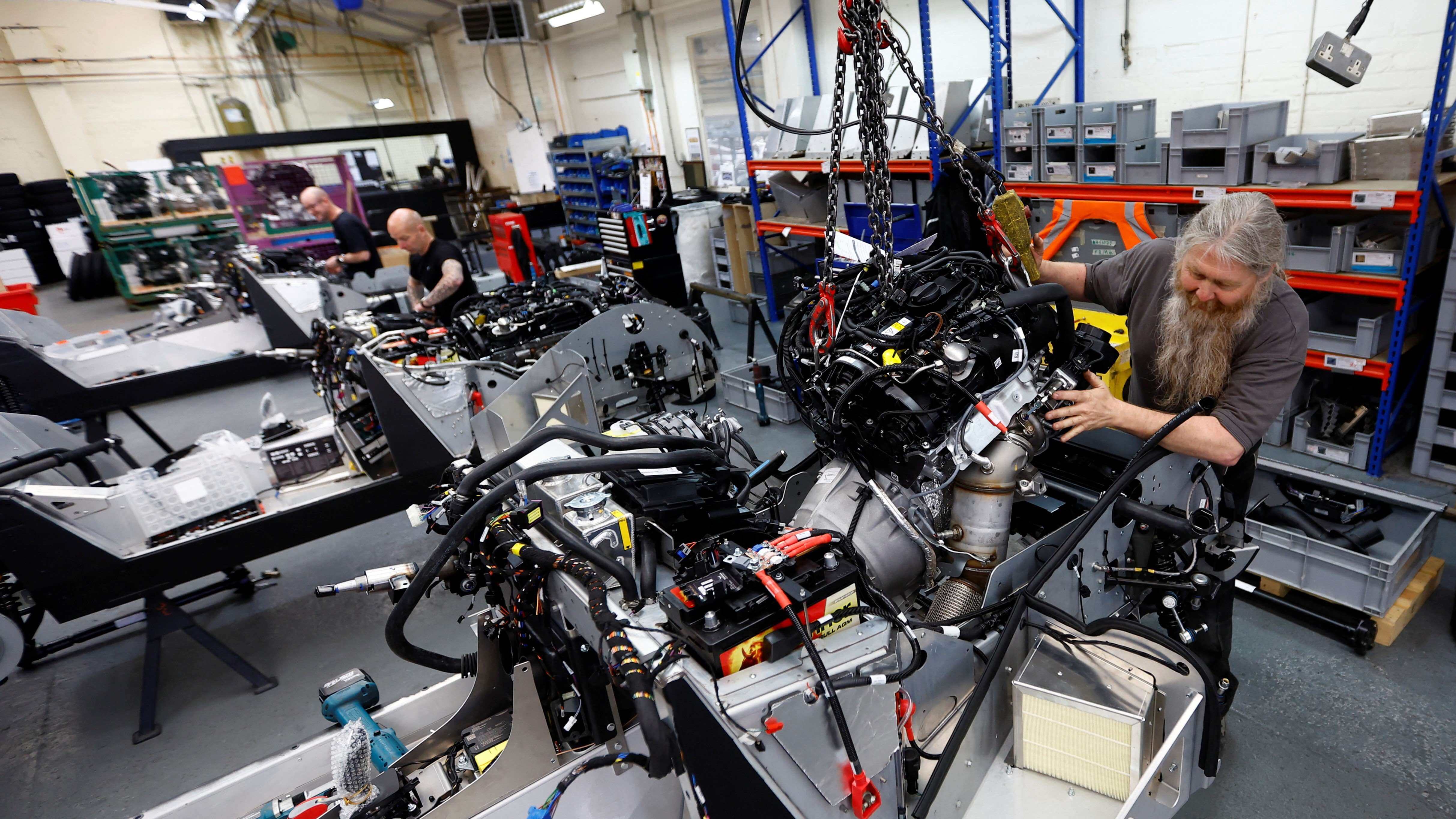

UK Manufacturing Downturn Eases As Output Decline Slows, CBI Survey Shows

Manufacturing output is still falling, but the pace of decline has moderated, according to the latest CBI data.

Manufacturing output in the UK continued to fall in the three months to December, although the rate of decline eased compared with the previous month, according to the Confederation of British Industry’s latest Industrial Trends Survey.

The survey, based on responses from 350 manufacturers, suggests activity remains under pressure, but with some tentative signs of stabilisation as firms look ahead to 2026. Manufacturers expect output to continue declining at a similar pace in the three months to March.

Output volumes fell at a weighted balance of minus 21 per cent in the quarter to December, an improvement from minus 30 per cent in the three months to November. Despite the slower pace of contraction, production declined in 15 of the 17 manufacturing sub-sectors surveyed, led by chemicals, metal products and mechanical engineering.

Order books also showed modest improvement, though they remain well below historical norms. Total order books were reported as below normal at minus 32 per cent in December, an improvement on November’s reading of minus 37 per cent, but still significantly weaker than the long-run average. Export orders followed a similar pattern, improving slightly month on month but remaining firmly in negative territory.

Manufacturers reported that stocks of finished goods were more than adequate, though the level of inventories eased compared with last month. At the same time, expectations for selling price inflation rose sharply, moving above the long-run average, suggesting firms may be attempting to pass on higher costs.

Ben Jones, lead economist at the CBI, said the data reflected a sector still struggling with weak demand and high costs, but with some relief following recent policy clarity.

“Manufacturing output is still falling, but the pace of decline has eased,” he said. “Activity was clearly held back by uncertainty ahead of the Budget, and with that now out of the way firms can look to 2026 with a little more certainty.”

However, Jones warned that significant challenges remain. “Demand is still soft, while high energy, labour and regulatory costs are squeezing margins. Ongoing uncertainty around key policies and global conditions continues to weigh on confidence,” he said.

He added that government action would be needed to support a recovery. Measures such as addressing industrial energy costs, providing clarity on employment regulation and removing barriers to investment would be critical to building momentum through 2026, he said.

While the latest figures point to easing pressure rather than a rebound, they suggest the sector may be moving towards a more stable footing after a prolonged period of weakness.

Thanks for signing up to Minutehack alerts.

Brilliant editorials heading your way soon.

Okay, Thanks!