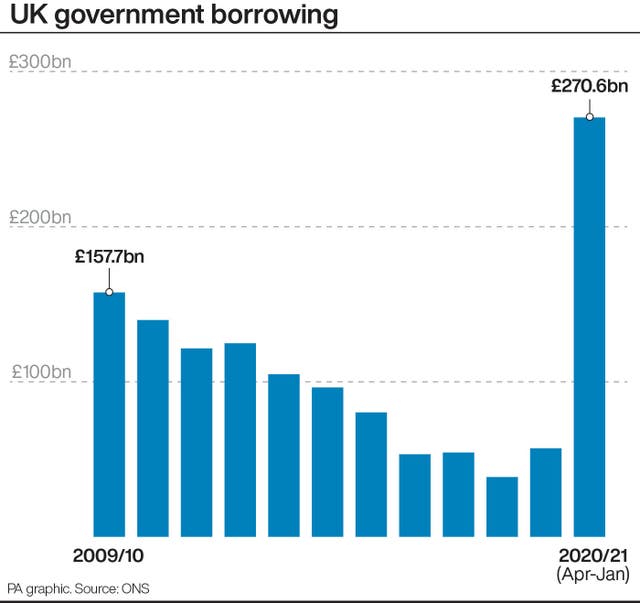

Government borrowing rises by £8.8bn in first January deficit for a decade

The Office for National Statistics has said it was the highest January borrowing figure since 1993.

Government borrowing jumped to £8.8 billion last month as the country’s debt soared to another record high, according to official figures.

The Office for National Statistics (ONS) said it was the first January deficit in a decade and highest borrowing figure for the month since 1993.

A consensus of analysts had predicted £25 billion in borrowing for the month.

Public sector net debt has risen by £316.4 billion over the 10 months since the start of April, at the onset of the coronavirus pandemic.

The ONS said the state debt has therefore increased to £2,114.6 billion at the end of January.

January is usually a key revenue-raising month for the state as it sees taxpayers submit their self-assessment returns.

The ONS said that the Government secured tax receipts of £63.2 billion for the month, representing a £800 million decline following the business rates break and VAT reductions.

Receipts from income tax increased by £1.4 billion to £16.8 billion in January, compared with the same month last year.

However, it posted a significant deficit amid £81.9 billion in central Government spending over the month – £19.7 billion more than the same month last year.

The Office for Budget Responsibility (OBR) has said it expects the public sector might borrow as much as £393.5 billion by the end of the financial year in March, which would be the highest amount in any year since the Second World War.

The money has been used to prop up parts of the economy, with more than £46 billion spent covering salaries as part of the furlough scheme, and tens of billions of pounds on guaranteeing loans to businesses.

In all, the Government has launched more than 40 schemes across the UK to help households and businesses through the coronavirus crisis.

Chancellor Rishi Sunak said: “Since the start of the pandemic we’ve invested over £280 billion to protect jobs, businesses and livelihoods across the UK – this is the fiscally responsible thing to do and the best way to support sustainable public finances in the medium term.

“We’ve been able to respond comprehensively and generously through this crisis because of our strong public finances.

“Therefore, it’s right that once our economy begins to recover, we should look to return the public finances to a more sustainable footing and I’ll always be honest with the British people about how we will do this.”

Thanks for signing up to Minutehack alerts.

Brilliant editorials heading your way soon.

Okay, Thanks!