Key Takeaways

- Invoice-based working capital solutions such as invoice factoring can rapidly improve cash flow, enabling businesses to meet ongoing financial demands and pursue growth opportunities.

- Unlike traditional loans, invoice factoring is a non-dilutive financing option, requiring no equity forfeiture or long-term debt obligations.

- Factoring firms may also assist with credit management and collections, reducing operational burdens for business owners.

- Evaluating providers, understanding terms and fees, and managing client expectations are essential for success with invoice factoring.

Understanding Invoice-Based Working Capital

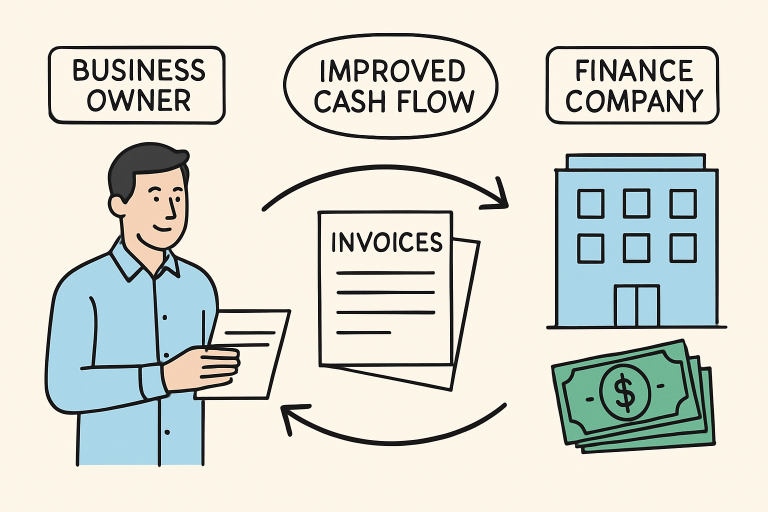

Invoice-based working capital solutions, particularly invoice factoring, empower businesses to address cash flow gaps by unlocking the value of outstanding invoices. Rather than waiting weeks or months for customers to pay, businesses can sell their receivables to a factoring company at a discount in exchange for immediate funding. This process is becoming increasingly popular among small to mid-sized enterprises seeking to bolster liquidity and stabilize their day-to-day operations.

The primary benefit of ScotPac invoice finance and similar offerings is the ability to leverage unpaid invoices as a flexible source of working capital. This is particularly valuable for companies in industries with lengthy billing cycles or businesses scaling up that encounter persistent cash flow bottlenecks.

By converting accounts receivable into working capital, businesses can maintain hiring, procurement, and marketing momentum. This expedient access to funds is often more efficient than seeking short-term bank loans or lines of credit, which may involve lengthy application processes and stringent approval criteria. In dynamic environments, this financial agility is a key competitive advantage.

Invoice-based funding is also highly adaptable. Whether your business is dealing with a seasonal uptick in sales or expanding into new markets, invoice factoring can be customized to fit unique cash flow requirements without accumulating long-term debt or giving up equity in your company.

The Role of Invoice Factoring in Business Growth

Predictable cash flow is a foundation for any growth-focused business. Invoice factoring fuels expansion by covering essential expenses at critical junctures, whether investing in technology, hiring talent, purchasing inventory, or entering untapped markets. With reliable access to cash, decision-makers can act on strategic opportunities quickly—often ahead of competitors relying solely on traditional financing.

The flexibility of invoice factoring also empowers businesses to accommodate fluctuating client payment terms or extended credit periods, common in sectors like manufacturing, logistics, and technology. This proactive approach helps to reduce the financial strain that slow-paying accounts can cause, bolstering resilience and enabling a more aggressive growth trajectory. According to Inc.com, invoice factoring is a proven resource for companies looking to boost working capital without the constraints of additional liabilities.

Advantages of Utilizing Invoice Factoring

- Immediate Access to Cash: Invoice factoring gives companies access to up to 90% of their receivables’ value, within as little as 24 to 48 hours, bridging gaps created by extended payment cycles.

- Non-Dilutive Financing: Unlike venture capital or angel investments, factoring does not require founders to give up equity or control over their business.

- Operational Efficiency: Many factoring companies offer services such as invoice collection and credit checks, allowing businesses to offload time-consuming administrative tasks and focus on growth.

- Improved Vendor and Employee Relationships: With liquidity concerns alleviated, businesses can pay suppliers and employees promptly, building trust and supporting long-term partnerships.

Implementing Invoice Factoring: A Step-by-Step Guide

- Evaluate Your Receivables: Identify eligible invoices by considering client payment history, outstanding balances, and invoice age. Generally, invoices from creditworthy customers are most attractive to factoring firms.

- Choose a Reputable Factoring Company: Look for partners with transparent terms, industry experience, and a record of strong client relationships.

- Negotiate Terms: Discuss advance rates, fees, contract lengths, and service levels to ensure alignment with your financing goals.

- Submit Invoices: Provide the chosen invoices to your factor and complete minimal paperwork—many providers now offer digital onboarding for added speed.

- Receive Funds: Funds are generally released within one to two business days, allowing businesses to take immediate action on operational and strategic needs.

Real-World Success Stories

Many Australian and global businesses are harnessing the power of invoice finance to accelerate growth. For example, a Melbourne-based AI technology startup suffered from cash flow challenges due to delayed client payments. This company unlocked critical capital by leveraging invoice factoring, enabling expanded hiring and a faster R&D cycle, leading to impressive year-on-year revenue gains. As noted in a feature in The Sydney Morning Herald, invoice factoring has been a lifeline for many startups facing similar bottlenecks—providing the capital needed to retain key employees and drive innovation.

Potential Challenges and Considerations

- Cost Implications: Invoice factoring entails fees, which may vary depending on industry, invoice value, and client risk factors. Calculating the true cost against your potential return on investment is important.

- Customer Perception: Some clients may be uneasy about third-party involvement in collections, so transparency and communication are critical.

- Contractual Obligations: Carefully review contracts to avoid pitfalls such as early termination fees, minimum volume requirements, or restrictive exclusivity clauses.

- Relationship Management: To protect your business relationships, ensure your factoring partner upholds high standards of professionalism when dealing with your customers.

Final Thoughts

Invoice-based working capital solutions such as factoring offer a powerful way for businesses of all sizes to stabilize cash flow, reinvest in operations, and confidently scale. By leveraging unpaid invoices, companies can support immediate needs and long-term ambitions—without sacrificing ownership or taking on unsustainable debt. A thoughtful, transparent approach to implementing invoice factoring and choosing the right partner is the key to unlocking these benefits while minimizing risks. You can also check resources at Forbes Advisor for further insights on how invoice-based finance works.

Thanks for signing up to Minutehack alerts.

Brilliant editorials heading your way soon.

Okay, Thanks!