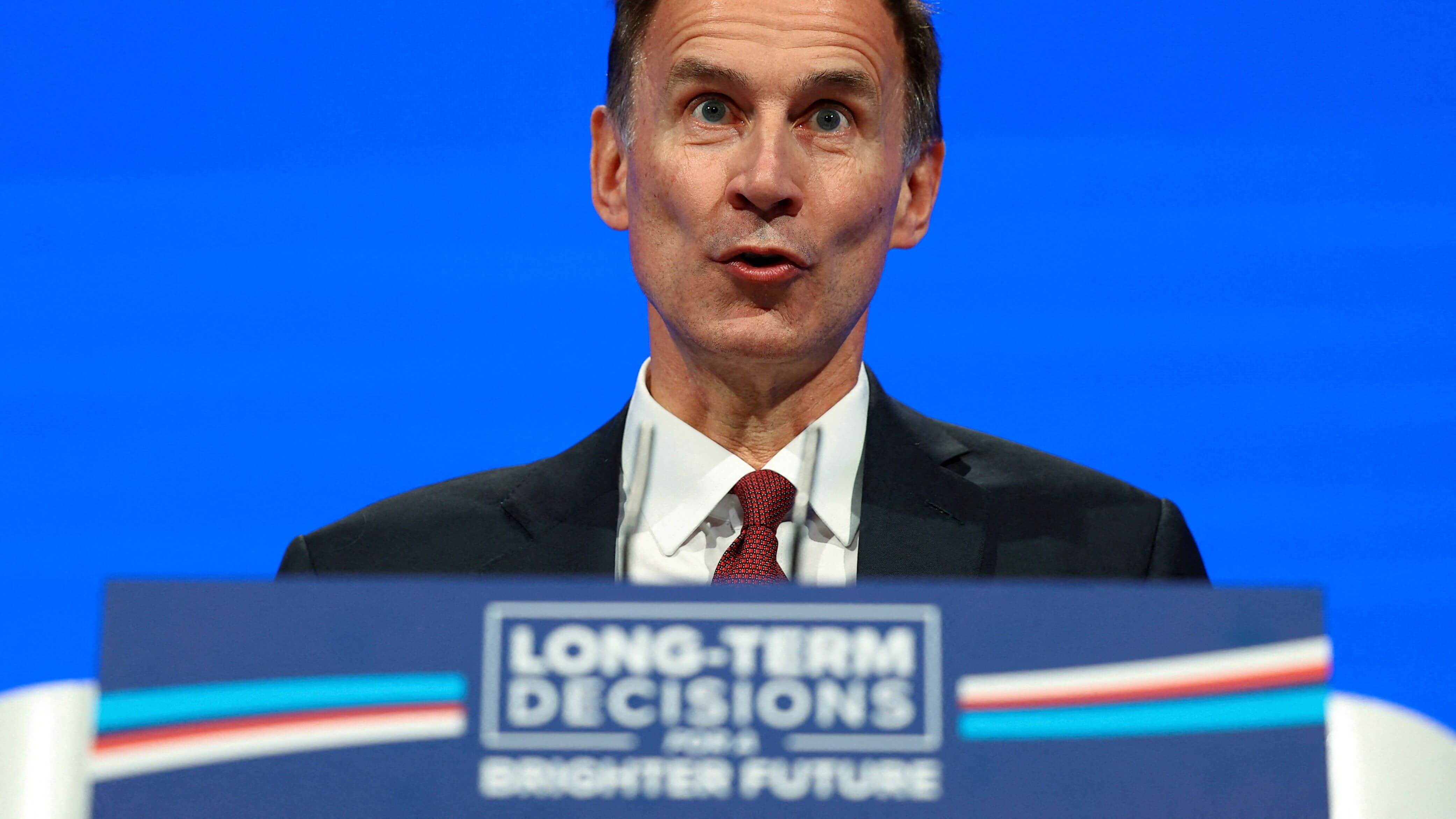

UK Think Tank Urges Hunt To Invest In Economy, Not Tax Cuts

Analysts believe tax cuts are likely before the next general election.

Britain's finance minister Jeremy Hunt must resist the temptation of pre-election tax cuts and instead boost investment in areas such as infrastructure and skills to snap the economy out of another decade in the doldrums, a think tank said.

On current trends, the bottom 50% of earners in the country will not see their inflation-adjusted incomes return to pre-COVID levels until the end of 2026, the National Institute of Economic and Social Research said on Wednesday.

The best way speed up the weak economy would be to increase public investment to 3% of gross domestic product every year and offer incentives for companies to invest more too, it said.

British public investment is set be about 3% of GDP this year but will fall to roughly 2% in coming years, a difference of around 30 billion pounds ($37 billion) annually.

"Certainly if the government has the fiscal space to do that, that is what they should be doing. What we do not want to see is a pre-election tax giveaway," Stephen Millard, a NIESR deputy director, said.

Hunt has warned lawmakers from his Conservative Party that he cannot cut taxes significantly in his Nov. 22 budget update speech as he focuses on bringing down high inflation.

But analysts believe tax cuts are likely before the election which must be held by January 2025, with the Conservatives lagging far behind the opposition Labour Party in opinion polls.

Labour has promised to raise business investment and to create a national wealth fund to leverage private investment. The government has unveiled reforms to encourage big pension funds to invest in infrastructure and is reportedly considering new business investment incentives.

Adrian Pabst, another NIESR deputy director, said the government should get regional and central government working more closely together to boost long-term investment in infrastructure, skills training, public housing and social care.

Higher public investment would encourage more private investment and improve Britain's weak productivity growth which is key to raising living standards over the long term, he said.

NIESR said it expected Britain's economy would expand by a weak 0.6% and 0.5% in 2023 and 2024 before growth picks up to 1.0% in 2025 and 1.7% by 2028, still below average levels before the 2008-09 financial crisis.

But Hunt will probably have enough fiscal wiggle room to increase public investment, helped by the erosion of nominal debt by high inflation, Millard said.

NIESR's forecasts saw inflation falling to 2% by the end of 2025, in line with the Bank of England's projections. NIESR said the BoE's benchmark interest rate had probably peaked at its current 5.25% level and would stabilise at between 3% and 3.5%.

(Writing by William Schomberg, editing by Andy Bruce)

Thanks for signing up to Minutehack alerts.

Brilliant editorials heading your way soon.

Okay, Thanks!